Here are some of the best M&A newsletters for legal practice professionals to learn about new technology, strategies, and philosophies about our work.

Best M&A Newsletters Shortlist

Here's a shortlist of the best M&A newsletters I think are worth joining in 2025:

- Morningstar — For financial analysis

- Reuters — For global news coverage

- S&P Global — For market intelligence

- Financial Times — For in-depth reporting

- M&A Dialogue — For European market insights

- Technology Holdings — For tech industry updates

- Mergers And Acquisitions Newsletter™ — For deal tracking

- M&A Science — For educational content

- PitchBook — For data-driven insights

- KPMG M&A Spotlight — For advisory services

- Mergers & Acquisitions — For middle market news

- BDO Canada — For Canadian market trends

- SRS Acquiom — For transaction management

- Fortune — For business news

- M&A Critique — For Indian market analysis

Find more details about each newsletter below.

Overview of the Best M&A Newsletters

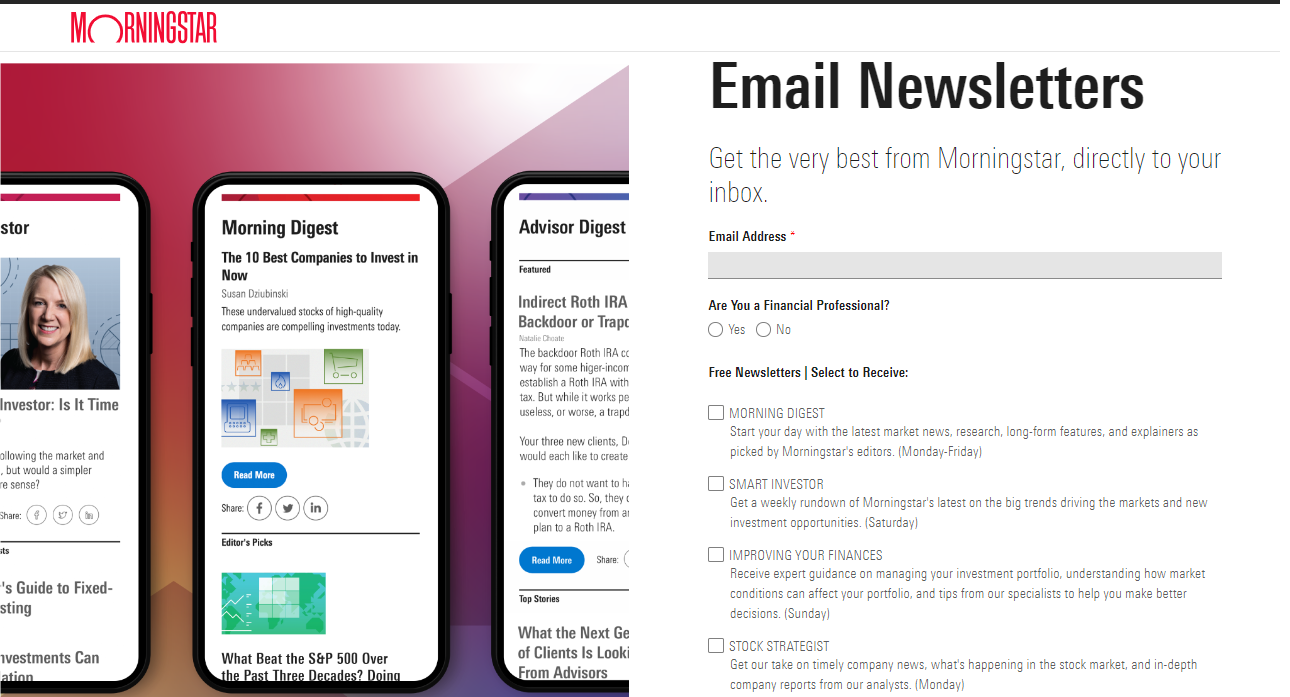

1. Morningstar — For financial analysis

Morningstar is a well-respected provider of investment analysis that is especially useful for mutual funds and ETFs.

- Audience: Advisors, wealth managers, asset managers, institutional investors, individual investors

- Newsletter Frequency: Weekly

- Cost: Free

- Subscribe Here

Why Subscribe:

Morningstar's newsletter provides comprehensive insights for financial professionals and individual investors. It covers data, wealth, retirement, ESG, and indexes and highlights products such as Morningstar Direct and PitchBook. The newsletter informs subscribers of the latest company news and updates, aiding investment decisions.

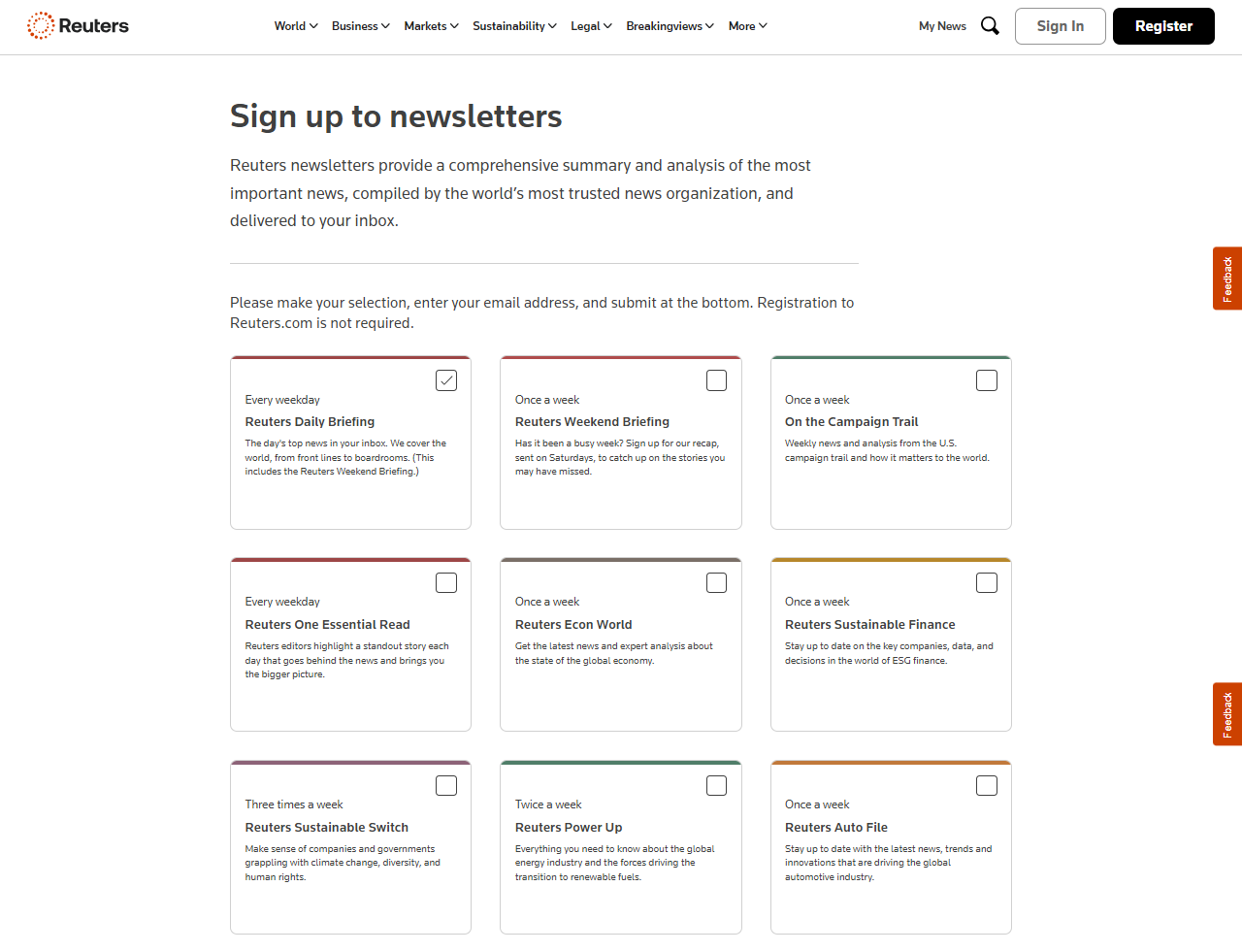

2. Reuters — For global news coverage

Reuters is a trusted news organization that provides accurate and timely news, which is essential for professionals and business owners.

- Audience: Professionals, business leaders, general public

- Newsletter Frequency: Daily and weekly

- Cost: Free

- Subscribe Here

Why Subscribe:

Reuters' newsletter covers extensive business, financial, national, and international news. It offers various newsletters, such as the Reuters Daily Briefing, Reuters Business, and Reuters Weekend Briefing, which directly deliver the day's top news to subscribers' inboxes.

3. S&P Global — For market intelligence

S&P Global newsletters offer insights and analysis on financial markets, industry trends, and economic developments to keep professionals and investors informed.

- Audience: Financial professionals, investors, business leaders

- Newsletter Frequency: Daily

- Cost: Free

- Subscribe Here

Why Subscribe:

The S&P Global newsletter offers detailed information on market intelligence, ratings, commodity insights, and sustainability. It features products such as S&P Capital IQ Pro and Platts Connect. It covers sustainability, private markets, energy transition, credit and risk, fixed income, supply chain, technology, and AI.

4. Financial Times — For in-depth reporting

The Financial Times is known for its high-quality journalism and in-depth reporting. It provides essential global M&A and business news for professionals and investors.

- Audience: Business professionals, investors, general public

- Newsletter Frequency: Daily, weekly

- Cost:

- Free

- Trial: $1 for 4 weeks

- Standard Digital: $39 per month

- Premium Digital: $75 per month

- Print: $50 for 3 months

- Subscribe Here

Why Subscribe:

The Financial Times offers a variety of newsletters covering finance, politics, economics, markets, trade, climate, work and careers, sport, education, energy, opinion, lifestyle, law, and international headlines. These newsletters, written by FT's award-winning journalists, provide detailed analysis and insights on the latest news and trends in their respective fields.

5. M&A Dialogue — For European market insights

The M&A Dialogue newsletter from Rödl & Partner covers mergers, acquisitions, and capital markets law. It offers insights on current M&A topics and expert explanations of various M&A terminology.

- Audience: Legal professionals, business leaders, investors

- Newsletter Frequency: Monthly

- Cost: Free

- Subscribe Here

Why Subscribe:

M&A Dialogue offers valuable insights into the European M&A market. It provides insights on current M&A topics and includes expert explanations of various M&A vocabulary terms. Stay informed on the latest developments with comprehensive newsletters, from M&A Dialogue to Thai Legal Newsflash.

6. Technology Holdings — For tech industry updates

The Technology Holdings newsletter updates on their services, sectors, deals, client feedback, research, and industry-focused M&A news, including healthcare and life sciences.

- Audience: Tech industry professionals, investors, and business leaders

- Newsletter Frequency: Monthly

- Cost: Free

- Subscribe Here

Why Subscribe:

Subscribing to Technology Holdings' newsletters gives you exclusive insights on M&A deals and trends in digital transformation, IT services, and healthcare. You’ll get updates on revenue comparisons between the S&P 500 Index and Technology Holdings Indices, detailed coverage of healthcare and life sciences deals, and key takeaways for strategic decisions.

7. Mergers And Acquisitions Newsletter™ — For deal tracking

The Mergers And Acquisitions Newsletter™ by Sebastian Amieva offers a wide range of articles and resources related to mergers and acquisitions, private equity investments, and business growth strategies.

- Audience: Investment bankers, dealmakers, private equity professionals

- Size: 140,000+ subscribers

- Newsletter Frequency: Weekly

- Cost: $149.99 annually

- Subscribe Here

Why Subscribe:

Subscribe to the Mergers & Acquisitions newsletters for comprehensive access to their content archive, the ability to post comments, and the ability to join the community. Get expert analysis, data, and interviews with industry leaders, and stay updated on the latest M&A updates and trends, including healthcare and life sciences deals.

8. M&A Science — For educational content

M&A Science, founded by Kison Patel, is a top community and educational platform for mergers and acquisitions professionals. It offers thought leadership content, practical training, and networking opportunities to optimize M&A practices.

- Audience: M&A professionals, business leaders, investors

- Size: 7,000+ subscribers

- Newsletter Frequency: Weekly

- Cost: Free

- Subscribe Here

Why Subscribe:

The M&A Science newsletter updates you on the latest from the M&A Science community and market. Gain access to behind-the-scenes stories, proven techniques to improve your M&A practice, live podcast invitations, networking events, exclusive offers, interview summaries, and more.

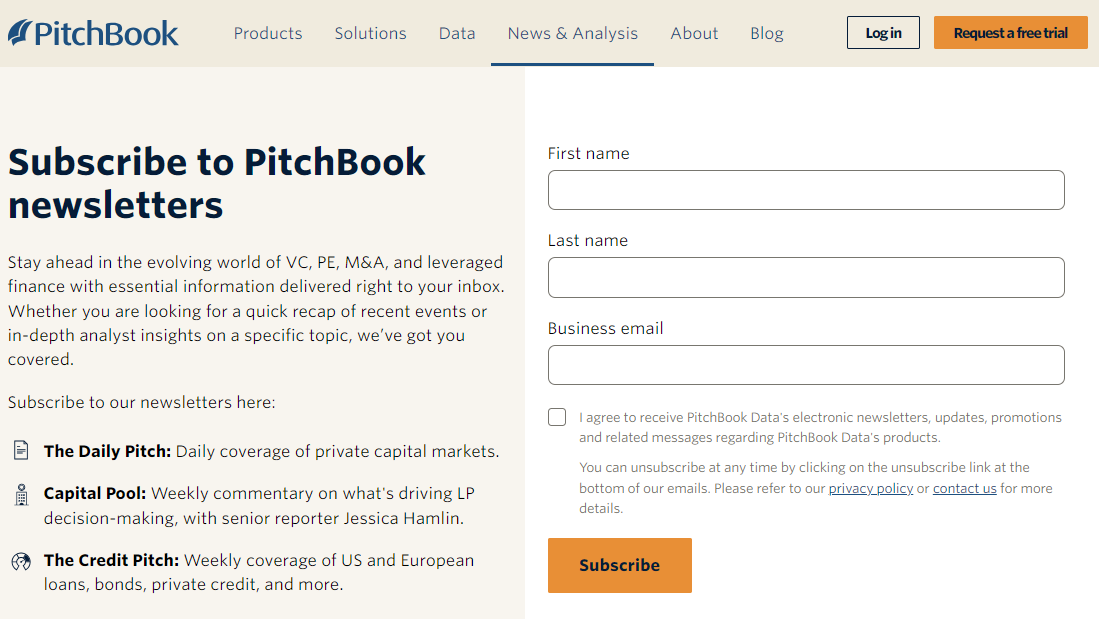

9. PitchBook — For data-driven insights

PitchBook newsletters are targeted publications providing financial data, analysis, and insights to private equity, venture capital, M&A, and related sector professionals.

- Audience: Financial professionals, investors, business leaders

- Newsletter Frequency: Daily and weekly

- Cost: Free

- Subscribe Here

Why Subscribe:

PitchBook offers newsletters such as "The Daily Pitch" for daily private capital market updates, "Capital Pool" for weekly insights on LP decision-making, and "The Credit Pitch" for weekly coverage of US and European loans and bonds. Subscribe to their newsletter page to stay informed about the latest trends in VC, PE, and M&A sectors.

10. KPMG M&A Spotlight — For advisory services

KPMG M&A Spotlight offers a concise overview of the latest M&A activity in Slovakia and internationally. The newsletter is designed for company owners and M&A professionals.

- Audience: Business leaders, investors, financial professionals

- Newsletter Frequency: Bi-weekly

- Cost: Free

- Subscribe Here

Why Subscribe:

Subscribe to KPMG's M&A Spotlight newsletter for exclusive, bi-weekly updates featuring in-depth analysis of the latest M&A trends in Slovakia and globally. Tailored for company owners and M&A professionals, it provides strategic guidance, expert opinions, and market forecasts, offering actionable intelligence that keeps you ahead in the dynamic M&A landscape.

11. Mergers & Acquisitions — For middle market news

Mergers & Acquisitions newsletter provides exclusive access to cutting-edge analysis and insider perspectives on the latest middle market transactions and trends.

- Audience: Middle market professionals, private equity firms, investment banks

- Newsletter Frequency: Daily

- Cost: Free

- Subscribe Here

Why Subscribe:

Mergers and Acquisitions newsletters update M&A news, trends, and analysis. They target private equity, investment banking, and corporate finance professionals, including detailed industry reports on significant deals, sector-specific insights, and strategic guidance for dealmakers.

12. BDO Canada — For Canadian market trends

The BDO Canada newsletter focuses on mergers and acquisitions and capital markets. It gives subscribers the latest updates and insights, making it an essential resource for business leaders and investors in Canada.

- Audience: Canadian business leaders, investors, financial professionals

- Newsletter Frequency: Daily

- Cost: Free

- Subscribe Here

Why Subscribe:

BDO Canada newsletters provide essential market updates, strategic advice, and transaction reports for mergers and acquisitions professionals. Each issue provides in-depth analysis, expert commentary, and regulatory updates to help professionals confidently navigate the complex M&A and capital markets landscape.

13. SRS Acquiom — For transaction management

The SRS Acquiom newsletter, founded by Paul Koenig and Mark Vogel, provides M&A professionals with the latest insights, market updates, and strategic advice.

- Audience: M&A professionals, business leaders, investors

- Newsletter Frequency: Quarterly

- Cost: Free

- Subscribe Here

Why Subscribe:

The SRS Acquiom newsletter provides insights on M&A, diligence, closing, post-closing, deal dashboards, loan agencies, and more. It covers deal terms analysis, due diligence, indemnification, life sciences, payments, and shareholder representation. SRS Acquiom offers comprehensive insights into transaction management and M&A activities.

14. Fortune — For business news

Fortune newsletter is produced by journalists and experts to offer clear updates and insights on business, finance, leadership, technology, and well-being.

- Audience: Business professionals, investors, general public

- Newsletter Frequency: Daily, weekly

- Cost:

- Monthly - $29.95

- Annual - $229

- Annual + Magazine - $259

- Subscriber Here

Why Subscribe:

The Fortune newsletter provides exclusive insights and expert analysis on the latest in business, finance, leadership, technology, and well-being. Subscribe for essential updates and practical advice tailored to help professionals and business leaders succeed in a rapidly changing world.

15. M&A Critique — For Indian market analysis

M&A Critique newsletters deliver expert analysis and updates on Indian mergers and acquisitions, ensuring professionals stay ahead with the latest trends and noteworthy deals.

- Audience: Indian business leaders, investors, legal professionals

- Newsletter Frequency: Monthly

- Cost: ₹ 1,180.00

- Subscribe Here

Why Subscribe:

Subscribing to the M&A Critique newsletter provides unique insights and expert critiques on middle market deals, corporate strategy for inorganic growth, transaction case studies, M&A happenings in the High Court, M&A Digest, legal insights and updates, leadership content, and more.

Join For More Insights

For more legal insights and resources, subscribe to our newsletter and join a community of innovative legal practitioners shaping the future of law.