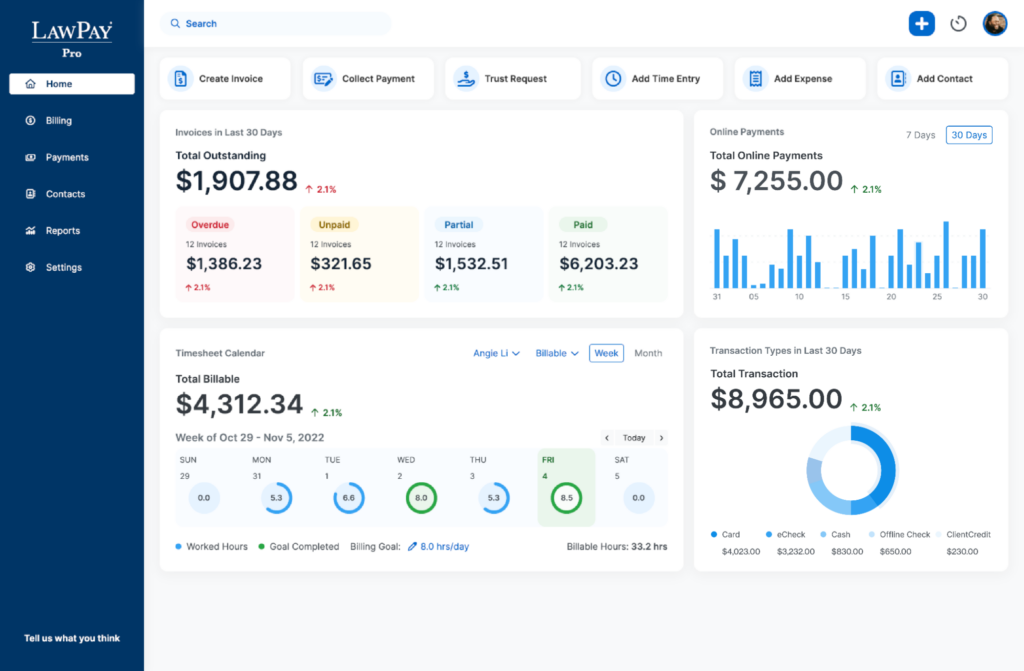

LawPay sets itself apart with an intuitive, easy-to-navigate interface that simplifies payment processing for legal professionals, streamlining their billing workflows. Its strong security features, including PCI compliance and advanced encryption, ensure that sensitive client information is protected, fostering trust and reliability.

In this review, I will share my analysis and evaluation based on hands-on experience with LawPay. You likely already know that LawPay is one of the most popular legal billing software options, but you may need a clearer understanding of its advantages and disadvantages. This comprehensive LawPay review will guide you through its pros and cons, features, and functionality, helping you determine if it's the right fit for your needs.

Summary: LawPay

LawPay is a payment processing solution designed specifically for legal professionals. Attorneys, law firms, and other legal service providers use LawPay to manage client payments and trust accounts efficiently. It helps with secure transactions, compliance with legal industry standards, and improving cash flow.

LawPay addresses common pain points like delayed payments, compliance issues, and complex billing processes. Its best features are secure payment processing, integration with legal practice management software, and detailed reporting tools.

LawPay Pros

- Security: LawPay is designed to meet the highest security standards, ensuring that all transactions are safe and compliant with industry regulations.

- Ease of use: The platform is user-friendly, making it simple for legal professionals to manage payments without extensive training.

- Client trust: LawPay is specifically tailored for legal professionals, which can enhance client trust and confidence in the payment process.

LawPay Cons

- Limited features: Compared to other legal billing software, LawPay may lack some advanced features that are available in more comprehensive solutions.

- Customer support: Some users have reported that customer support can be slow to respond or not as helpful as expected.

- Customization: The platform offers limited customization options, which may not meet the specific needs of all law firms.

LawPay Expert Opinion

In my opinion, LawPay is an effective legal billing software, especially for small to mid-sized law firms. Its user-friendly interface and integration with over 30 legal practice management platforms make it a popular choice among legal professionals. LawPay's compliance with IOLTA and ABA guidelines ensures it meets the strict requirements of the legal industry, setting it apart from many competitors. The software's ability to separate earned and unearned fees and protect IOLTA accounts enhances trust and reliability.

LawPay's customer support is known for its responsiveness and helpfulness, which is crucial for busy legal professionals. However, the service fees are relatively high, and some users have noted limited customization options for reports. Despite these drawbacks, LawPay's ease of setup, intuitive features, and strong security measures make it a valuable tool for legal billing, particularly for firms seeking a reliable and compliant payment solution.

Why Trust Our Software Reviews

We’ve been testing and reviewing legal billing software since 2023. As legal tech researchers ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different legal practice use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

-

Mitratech Managed Bill Review

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.2 -

Filevine

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7 -

MyCase

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.4

Are You A Good Fit For LawPay?

Who would be a good fit for LawPay?

The tool is well-suited for medium to large-sized law firms but also finds its place as a simple small law firm billing software. It integrates seamlessly with various legal practice management software, simplifying the billing and payment process. Its compliance with ABA and IOLTA guidelines provides assurance that it can safely handle sensitive financial transactions.

Who would be a bad fit for LawPay?

Large law firms with complex billing requirements or a need for extensive customization may find LawPay limiting. The software is designed for straightforward payment processing and may lack the advanced features or scalability that larger firms require. Additionally, firms with an existing comprehensive billing system may not experience significant advantages from switching to LawPay.

Best Use Cases for LawPay

- Small law firms: LawPay is highly recommended for small law firms due to its ease of use and ability to handle automatic recurring payments, making it simple to manage client billing.

- Credit card processing: LawPay excels in credit card processing, providing a secure and efficient way for clients to make payments, which is crucial for legal practices.

- Trust accounting: The software's trust accounting capabilities ensure compliance with legal ethical rules, making it a reliable choice for law firms that need to manage client funds.

- Integration with other software: LawPay integrates seamlessly with other legal practice management software like Clio and Cosmolex, streamlining billing and payment processes.

- Client payment convenience: The platform allows clients to pay invoices online easily, which enhances client satisfaction and speeds up the payment process.

- Customer support: LawPay is praised for its responsive customer service, which quickly addresses any issues, ensuring a smooth user experience.

Worst Use Cases for LawPay

- Large corporations: Large corporations may find LawPay's features limited compared to more comprehensive financial management systems that offer extensive integrations and customization options.

- Non-legal industries: Businesses outside the legal industry might not benefit from LawPay's specialized features, which are tailored specifically for legal practices.

- High-volume transactions: Firms that handle a high volume of transactions might find the processing fees to be higher compared to other payment solutions, making it less cost-effective.

- Advanced customization needs: Users requiring extensive customization options may find LawPay lacking, as it offers limited features to personalize the experience.

- Paperless statements: Firms that prefer fully digital operations might be frustrated by LawPay's lack of paperless monthly statements, which can complicate accounting processes.

- API integrations: Companies that rely heavily on API integrations with various business tools might find LawPay less flexible, as it does not offer extensive integration options like some non-legal specific payment solutions.

-

Mitratech Managed Bill Review

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.2 -

Filevine

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7 -

MyCase

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.4

LawPay Evaluation Summary

- Core Functionality: ⭐⭐⭐⭐⭐

- Standout Features: ⭐⭐⭐⭐⭐

- Ease of Use: ⭐⭐⭐⭐⭐

- Onboarding: ⭐⭐⭐⭐⭐

- Customer Support: ⭐⭐⭐⭐⭐

- Integrations: ⭐⭐⭐⭐

- Customer Reviews: ⭐⭐⭐⭐⭐

- Value for Money: ⭐⭐⭐⭐

Review Methodology

We are a team of software experts focused on analyzing the features and functionality of various platforms. We understand that choosing the right software can be both critical and confusing. To help, we rigorously test and score software to identify the best solutions for any use case.

Using a data-driven, objective testing methodology, we've evaluated over 300 software platforms. Our goal is to cut through marketing fluff and provide an honest assessment of each platform's capabilities. We create comprehensive testing scenarios that simulate real-world use, combining our hands-on experience with insights from users, experts, and software vendors.

How We Test & Score Legal Billing Software

We’ve spent years building, refining, and improving our software testing and scoring system for legal billing software. The rubric is designed to capture the nuances of software selection, and what makes legal billing software effective, focusing on critical aspects of the decision-making process.

Below, you can see exactly how our testing and scoring works across eight criteria. It allows us to provide an unbiased evaluation of the software based on core functionality, standout features, ease of use, onboarding, customer support, integrations, customer reviews, and value for money.

Core Functionality (25% of final scoring)

For legal billing software, the core functionality we test and evaluate are:

- Legal Time Tracking Tools: Accurately records billable hours and integrates with case management.

- Invoicing: Generates detailed and customizable invoices for clients.

- Expense Tracking: Monitors and categorizes expenses related to cases.

- Payment Processing: Facilitates secure and efficient client payments.

- Reporting: Provides comprehensive financial reports and analytics.

- Compliance: Ensures adherence to legal billing standards and regulations.

Standout Features (20% of final scoring)

We evaluate uncommon, standout features that go above and beyond the core functionality defined and typically found in legal billing software. A high score reflects specialized or unique features that make the product faster, more efficient, or offer additional value to the user.

Ease of Use (15% of final scoring)

We consider how quick and easy it is to execute the tasks defined in the core functionality using the legal billing software. High scoring software is well designed, intuitive to use, offers mobile apps, provides templates, and makes relatively complex tasks seem simple.

Onboarding (10% of final scoring)

We know how important rapid team adoption is for a new platform, so we evaluate how easy it is to learn and use the legal billing software with minimal training. We evaluate how quickly a team member can get set up and start using the software with no experience. High scoring software indicates little or no support is required.

Customer Support (10% of final scoring)

We review how quick and easy it is to get unstuck and find help by phone, live chat, or knowledge base. Legal billing software that provides real-time support scores best, while chatbots score worst.

Integrations (10% of final scoring)

We evaluate how easy it is to integrate with other tools typically found in the tech stack to expand the functionality and utility of the software. Legal billing software offering plentiful native integrations, 3rd party connections, and API access to build custom integrations score best.

Customer Reviews (10% of final scoring)

Beyond our own testing and evaluation, we consider the net promoter score from current and past customers. We review their likelihood, given the option, to choose the legal billing software again for the core functionality. A high-scoring software reflects a high net promoter score from current or past customers.

Value for Money (10% of final scoring)

Lastly, in consideration of all the other criteria, we review the average price of entry level plans against the core features and consider the value of the other evaluation criteria. Software that delivers more, for less, will score higher.

LawPay Review

Legal billing software functionality includes features like time tracking, invoicing, and expense management, all designed to simplify the billing process. What sets LawPay apart from similar software is its focus on security and compliance with legal financial guidelines. Here are more details:

Core Legal Billing Software Functionality

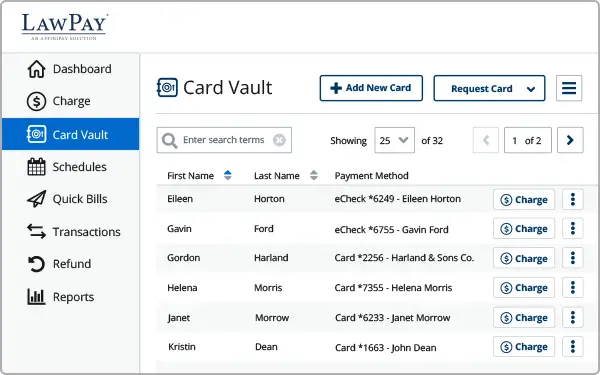

Credit and debit card payments: LawPay allows law firms to accept credit and debit card payments from clients. This feature ensures that payments are processed quickly and securely, enhancing the firm's cash flow.

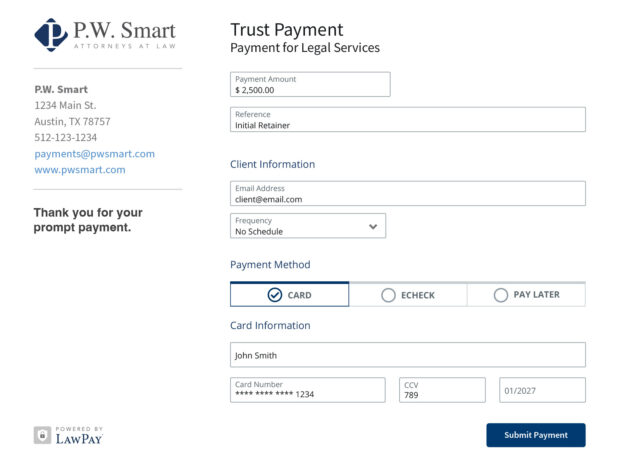

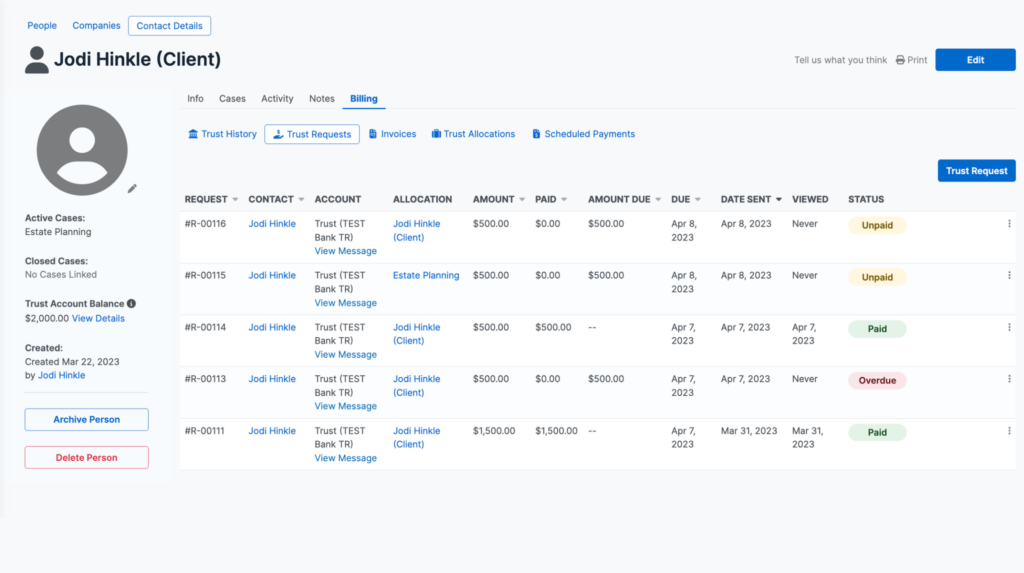

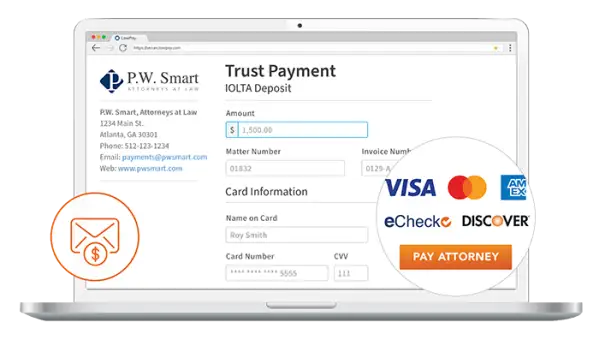

Trust Payments: This function allows law firms to accept payments directly into their trust accounts, ensuring compliance with legal requirements for handling client funds. It is particularly useful for managing retainers and maintaining clear separation between earned and unearned fees.

LawPay facilitates secure trust payments, ensuring compliance with legal regulations

Client and Matter Management: Law firms can organize billing information by client and matter, allowing for easy access to case details, billing history, and outstanding balances. This centralized approach streamlines financial management and enhances overall client service.

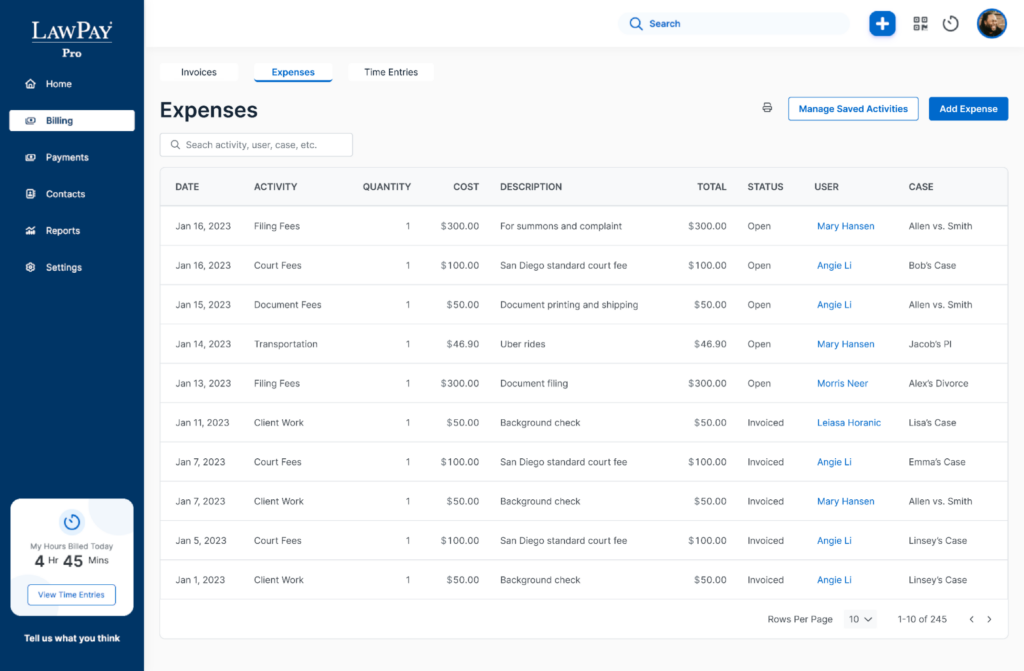

Expense Tracking: Law firms can record and categorize client-related expenses, such as filing fees, travel costs, and other disbursements, to ensure accurate billing and reimbursement.

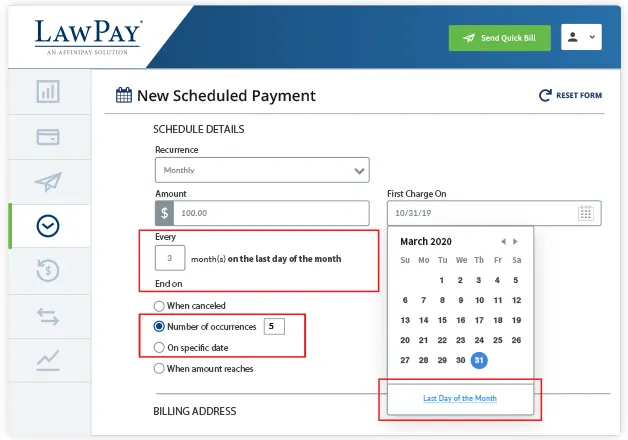

Scheduled payments: LawPay allows firms to set up scheduled payments, enabling clients to make recurring payments automatically. This feature is beneficial for managing ongoing legal fees and ensuring timely payments.

Invoicing: Law firms can generate customized invoices based on tracked time and expenses, accommodating various billing arrangements such as hourly rates, flat fees, or contingency fees.

LawPay Standout Features

IOLTA compliance: LawPay ensures compliance with Interest on Lawyers Trust Accounts (IOLTA) regulations. This feature is crucial for law firms as it helps manage client funds ethically and legally, preventing the commingling of client and firm funds.

Mobile App: LawPay provides a mobile app with features that enable law firms to process payments, view transaction history, and manage client accounts from anywhere. The app's intuitive interface and real-time notifications help legal professionals stay on top of their financial operations while on the move.

Ease of use

LawPay is considered easier to use than many other legal billing software options. Its intuitive interface and straightforward setup make it accessible even for users who are not tech-savvy. Features like scheduled billing and stored payment methods simplify the payment process for both law firms and their clients. User reviews consistently rate LawPay highly for its ease of use, with many praising its user-friendly design and efficient functionality.

Onboarding

New users will experience a smooth onboarding process with LawPay. The company provides extensive training resources, including live online sessions, digital guides, and in-person support. Most new customers can set up their accounts and begin collecting payments within 24 hours. Compared to other legal billing software, LawPay offers a quick and efficient onboarding process, supported by a dedicated team of payment experts available to assist at every step.

Customer support

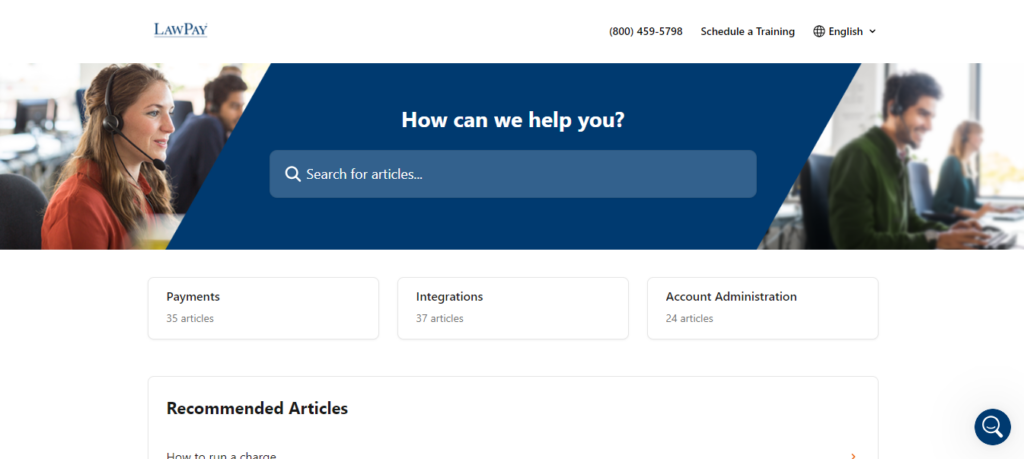

LawPay provides multiple customer support options, including a dedicated phone line for immediate assistance, email support for non-urgent inquiries, and live chat for real-time problem-solving. Users can also access instructional videos to learn key features and explore online resources such as FAQs and guides in the support center. Additionally, LawPay offers Continuing Legal Education (CLE) webinars hosted by practicing attorneys and maintains a status page to monitor system uptime and downtime.

Integrations

LawPay integrates natively with Clio, MyCase, PracticePanther, Rocket Matter, TimeSolv, Tabs3, QuickBooks, Xero, Zoho, and LawGro.

LawPay offers options through an API, allowing for custom integrations. Users can also leverage Zapier to connect LawPay with other apps and services, expanding its functionality and integration capabilities. The availability of an apps marketplace further enhances the software's versatility, making it adaptable to various legal practice needs.

Value For Money

LawPay offers several pricing plans, generally falling within the average range for legal billing functionality, though its fees can seem high compared to non-legal payment solutions. It is designed primarily for small to mid-sized law firms and solo practitioners.

LawPay’s pricing begins with a Basic plan at $19 per month, with transaction fees of 2.95% + $0.20 for Visa, MasterCard, and Discover; 3.75% + $0.20 for American Express; 1% per transaction for eChecks (capped at $10); and 4.95% for Pay Later transactions. The total cost can vary based on transaction volume and the types of payment processed.

LawPay does not publicly list all pricing details, so firms needing special processing options or technical requirements must contact the sales team for a customized quote. Based on my research and discussions with other legal professionals, the pricing typically includes a base monthly fee, with additional costs for certain payment types and features. Extra fees may apply for custom configurations, additional integrations, or advanced support services.

Product Specifications

| Feature | LawPay |

| Time Tracking | ❌ |

| Invoicing Assistance | ✅ |

| Reporting | ❌ |

| Project Management | ❌ |

| Accounts Management | ❌ |

| Customization | ✅ |

| Support | ✅ |

| Client Management | ✅ |

| Branding | ✅ |

| Billable Hours Calculation | ✅ |

| Payment Reminders | ✅ |

| Mobile Access | ✅ |

| Automated Time Tracker | ❌ |

| Detailed Reports with Filters | ❌ |

| Online Project Planning and Task Allocation | ❌ |

| Accounts Receivables & Payables Management | ❌ |

| Implementation & Customization | ✅ |

| Assistance & Guidance | ✅ |

| Trust Accounting | ❌ |

| LEDES Billing | ❌ |

| Retainer Payments | ❌ |

| Expense Tracking | ❌ |

| Document Storage | ❌ |

| Document Sharing | ❌ |

LawPay Alternatives

If you’re looking for alternative legal billing software options to LawPay, here are a few worth checking out:

- TimeSolv: TimeSolv is known for its strong integration capabilities with other tools like QuickBooks, making it ideal for small to medium law firms needing efficient billing solutions.

- Soluno: Cloud-based legal billing software with comprehensive tools to manage time tracking, invoicing, and client payments

- Clio: Ideal for firms looking for a comprehensive practice management tool with extensive customization options.

Read more: What it takes to be a legal billing specialist.

LawPay Frequently Asked Questions

What is LawPay?

LawPay is a payment processing solution designed specifically for law firms. It allows legal professionals to accept credit card, debit card, and eCheck payments securely. LawPay ensures compliance with trust accounting rules and integrates with various legal software to streamline billing and payment processes.

Is there a mobile app for LawPay?

Yes, LawPay offers a mobile app available for both iOS and Android devices. The app allows legal professionals to securely accept payments from their smartphones or tablets. Users can manually enter payment details or use a Bluetooth reader/swiper for convenience.

Is LawPay HIPAA compliant?

LawPay is designed to meet stringent security standards, including those required for HIPAA compliance. This ensures that sensitive client and patient information is protected, making it suitable for law firms that handle health care-related legal matters.

Is LawPay SOC 2 compliant?

Yes, LawPay is SOC 2 compliant. This compliance demonstrates LawPay’s commitment to maintaining high standards of data security and privacy. SOC 2 compliance involves rigorous auditing to ensure that customer data is managed securely.

Is LawPay secure?

LawPay employs multiple layers of security to protect sensitive information. This includes 256-bit military-grade encryption, regular vulnerability scans, and compliance with PCI DSS Level 1 standards. LawPay also uses advanced permissions and controls to monitor and regulate access to sensitive data.

Is LawPay FedRAMP certified?

LawPay is not FedRAMP certified. FedRAMP certification is typically required for cloud service providers working with federal agencies, and LawPay focuses on providing secure payment solutions specifically for the legal industry.

Is LawPay GDPR compliant?

Yes, LawPay is GDPR compliant. This means that LawPay adheres to the regulations set forth by the General Data Protection Regulation (GDPR) to protect the personal data of individuals in the European Union. LawPay ensures that data is collected, processed, and stored in compliance with GDPR requirements.

How does LawPay protect my IOLTA account?

LawPay is designed to ensure compliance with IOLTA (Interest on Lawyers Trust Accounts) regulations. It prevents the commingling of earned and unearned funds by allowing payments to be directed into the appropriate accounts. This helps law firms maintain ethical and legal standards in managing client funds.

Does LawPay have a free plan?

No, but you can check out the best free legal billing software for budget-conscious practices.

LawPay Company Overview & History

LawPay specializes in legal payment technology, offering payment processing solutions tailored to the legal industry. The platform supports credit and debit card payments, eCheck payments, legal fee financing, billing and invoicing, time and expense tracking, and QuickBooks integration.

LawPay provides advanced security features, IOLTA compliance, and next-day payments to improve cash flow for law firms. Recommended by all 50 state bars and over 60 local and specialty bars, it is the only payment solution included in the ABA Advantage program. Founded in 2005 and based in Austin, TX, LawPay has grown to 125 employees and $4.4 million in annual revenue.

It is a private company, part of AffiniPay, and is known for its strong work culture. LawPay is vetted and approved by over 125 state and local bar associations and trusted by more than 40,000 law firms. The company exceeds PCI Data Security Standards, ensuring secure transactions, and recently launched a new legal billing software, LawPay Pro.

LawPay Major Milestones

- 2005: LawPay was founded by Amy Porter.

- 2005: The product was released, providing legal payment solutions tailored for law firms.

- 2022: AffiniPay, the parent company of LawPay, acquired MyCase, a legal practice management software company.

- 2023: LawPay announced the launch of LawPay Pro, a new legal billing software solution.

- 2024: LawPay introduced next-day payments, allowing quicker access to funds for its users.

- 2024: LawPay expanded into Puerto Rico with payment solutions LawPay and CPACharge.

- 2024: LawPay launched MyCase Smart Spend, a new spend management solution for the legal industry.

Want to learn more about LawPay? Check out their site for additional information.

What’s Next?

For more legal insights and resources, subscribe to our newsletter and join a community of innovative legal practitioners shaping the future of law.