Best Legal Invoicing Software Shortlist

Here’s my shortlist of the best legal invoicing software:

Get free help from our project management software advisors to find your match.

Legal invoicing software is a valuable asset for any company. With the right software, teams can improve billing accuracy and enhance financial management. But finding the right legal invoicing software can be a challenge, especially with so many options available.

Using my experience with legal billing software of all types, I tested and compared several of the top legal invoicing software available. From there, I compiled my results into detailed reviews to help you find the best software for your needs.

What Is Legal Invoicing Software?

Legal invoicing software is designed to help law firms and legal professionals manage billing and financial tasks efficiently. These tools are generally used by attorneys, paralegals, and firm administrators to ensure accurate billing and financial management.

Time tracking, automated billing, payment options, and client portals help maintain transparency, optimize billing processes, and enhance client satisfaction. These tools are a type of legal billing software that provides value by improving the financial accuracy and operational efficiency of legal practices.

Why Trust Our Software Reviews

We’ve been testing and reviewing legal practice software since 2023. As legal tech researchers, we know how critical and challenging it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions.We’ve tested more than 2,000 tools for different legal practice use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & check out our software review methodology.

Best Legal Invoicing Software Summary

This comparison chart summarizes pricing details for my top legal invoicing software selections, helping you find the best one for your budget and law practice needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for small law firms | Free demo available | From $3.80/month | Website | |

| 2 | Best for custom invoicing | Free plan available | From $9/month (billed annually) | Website | |

| 3 | Best for solo practitioners | 7-day free trial | From $49/user/month | Website | |

| 4 | Best for built-in compliance | Free trial available | From $79/user/month (billed annually) | Website | |

| 5 | Best for large law firms | Free demo available | Pricing available upon request | Website | |

| 6 | Best for affordability | Free plan available | From $10/user/month | Website | |

| 7 | Best for offline access | 30-day free trial | From $39.95/user/month (billed annually) | Website | |

| 8 | Best for time tracking | 14-day free trial | From $27/user/month (billed annually) | Website | |

| 9 | Best for corporate legal teams | Free demo available | Pricing upon request | Website | |

| 10 | Best for payment processing | 7-day free trial + free demo available | From $39/user/month (billed annually) | Website |

-

CARET Legal

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Redactable

Visit Website -

Mitratech TAP Workflow Automation

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.2

Best Legal Invoicing Software Reviews

Below are my detailed summaries of my shortlist’s best legal invoicing software. My reviews offer a detailed look at each tool’s key features, pros and cons, integrations, and ideal use cases to help you find the best one for you.

QuickBooks is a financial management tool tailored for small law firms. It helps with invoicing, expense tracking, and financial reporting and is designed to assist small teams in managing their finances efficiently.

Why I picked QuickBooks: It offers a user-friendly interface that makes financial management accessible to small law firms. QuickBooks provides customizable invoices, allowing you to tailor billing to your firm's needs. The software's expense tracking and reporting features help maintain accurate financial records. Its integration with banking systems simplifies transactions, aligning with its USP of being best for small law firms.

Standout features & integrations:

Features include customizable invoicing, which lets you adjust invoices to fit your firm's branding. Expense tracking keeps all your financial transactions organized and categorized. Financial reporting gives insights into your firm's financial health, helping with decision-making.

Integrations include PayPal, Square, Shopify, Bill.com, TSheets, Expensify, Gusto, Salesforce, HubSpot, and Stripe.

Pros and cons

Pros:

- Strong reporting tools

- Easy bank integration

- Customizable invoices

Cons:

- Complex setup process

- Limited legal features

Zoho Invoice is an invoicing solution for small—to medium-sized law firms focusing on billing and financial management. It helps teams create professional invoices and manage their billing processes efficiently.

Why I picked Zoho Invoice: It offers extensive customization options for invoices, making it ideal for firms that need tailored billing solutions. With its custom templates, you can design invoices that reflect your brand. The software also supports multiple currencies and tax configurations, adding flexibility for firms with diverse client bases. Its automation features, such as recurring invoicing, further enhance its customizability.

Standout features & integrations:

Features include customizable invoice templates that let you personalize billing documents. Recurring invoicing automates the billing process for regular clients. Multi-currency support allows your firm to handle international billing with ease.

Integrations include Zoho Books, Zoho CRM, PayPal, Stripe, Authorize.Net, Zoho Projects, Zoho People, Slack, Dropbox, and Google Drive.

Pros and cons

Pros:

- Automated invoicing

- Supports multiple currencies

- Great customization options

Cons:

- Complex setup process

- Limited offline access

Practice Panther is legal practice management software designed primarily for solo practitioners and small law firms. It focuses on billing, case management, and client communications and helps attorneys manage their practice efficiently from one platform.

Why I picked Practice Panther: It offers a straightforward interface ideal for solo practitioners who need to manage their practice with minimal hassle. The tool provides efficient case management features, allowing you to organize all your case details in one place. Time tracking and billing functionalities ensure you capture every billable hour and generate accurate invoices. Its client communication tools keep you connected with your clients, aligning with its USP of being best for solo practitioners.

Standout features & integrations:

Features include case management that organizes your files and documents. Time tracking captures billable hours efficiently, ensuring accurate billing. The client portal lets clients access their case information, enhancing communication.

Integrations include QuickBooks Online, Dropbox, Google Calendar, LawPay, Outlook, Zapier, Mailchimp, Box, Microsoft Teams, and OneDrive.

Pros and cons

Pros:

- Intuitive client portal

- Strong billing tools

- Easy case management

Cons:

- Basic reporting tools

- Limited advanced features

CosmoLex is practice management software for small to mid-sized law firms. It focuses on billing, accounting, and compliance management. It integrates legal accounting and billing into a single platform, making it easier for firms to manage their finances.

Why I picked CosmoLex: Its unique feature combines billing and accounting with compliance management. The software helps your firm comply with legal industry standards while managing finances. Automated trust accounting ensures your firm adheres to legal regulations without manual intervention. Its all-in-one platform means you won't need separate systems for billing and accounting, simplifying your operations.

Standout features & integrations:

Features include automated trust accounting, which helps your firm maintain compliance with legal standards. Integrated billing and accounting provide a unified platform for managing your finances. Compliance management tools ensure your firm effortlessly meets industry regulations.

Integrations include QuickBooks Online, LawPay, NetDocuments, Dropbox, Box, Google Drive, HubSpot, Gmail, Outlook, and Microsoft 365.

Pros and cons

Pros:

- Automated trust accounting

- All-in-one financial management

- Built-in compliance tools

Cons:

- Limited customization options

- Some learning curve

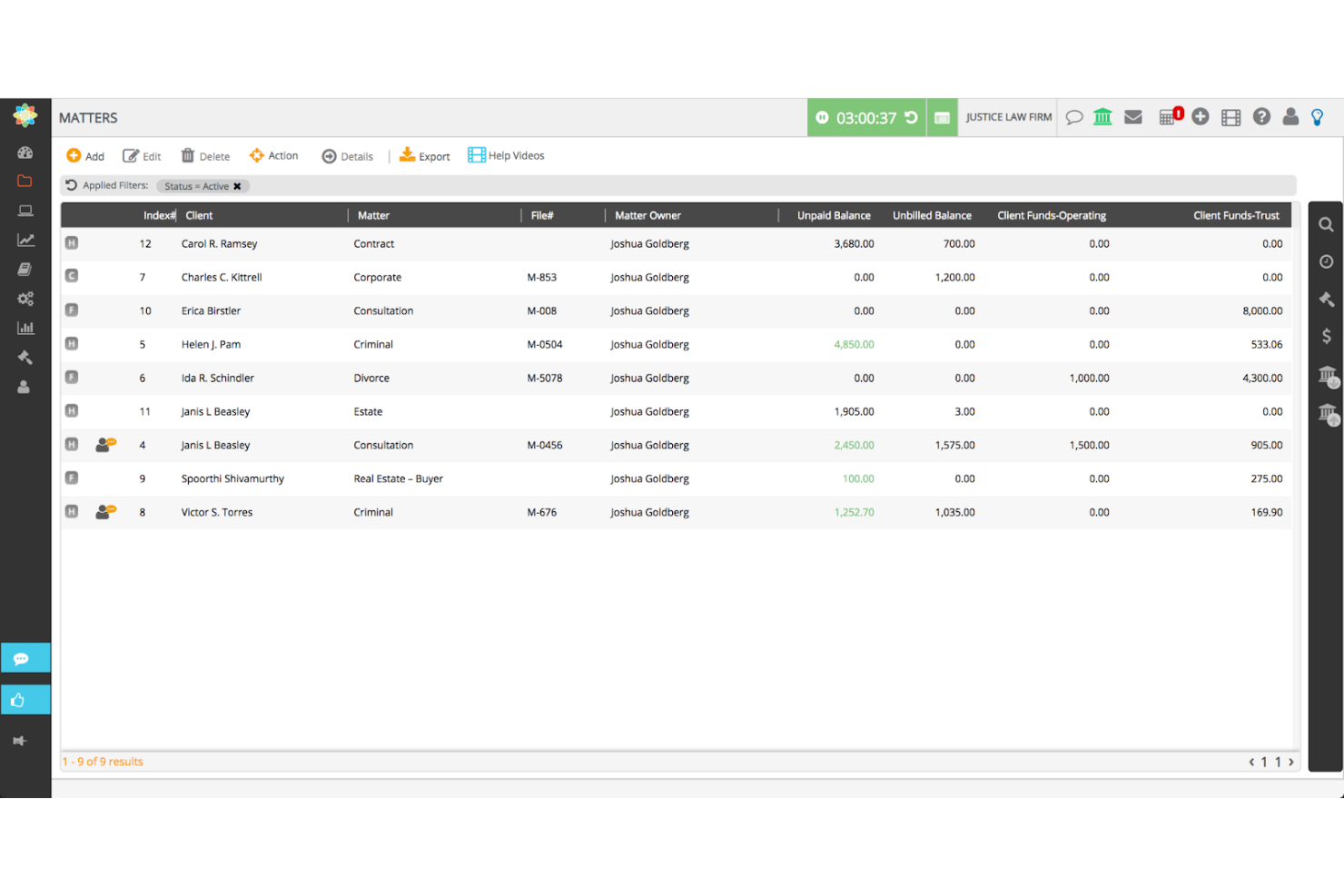

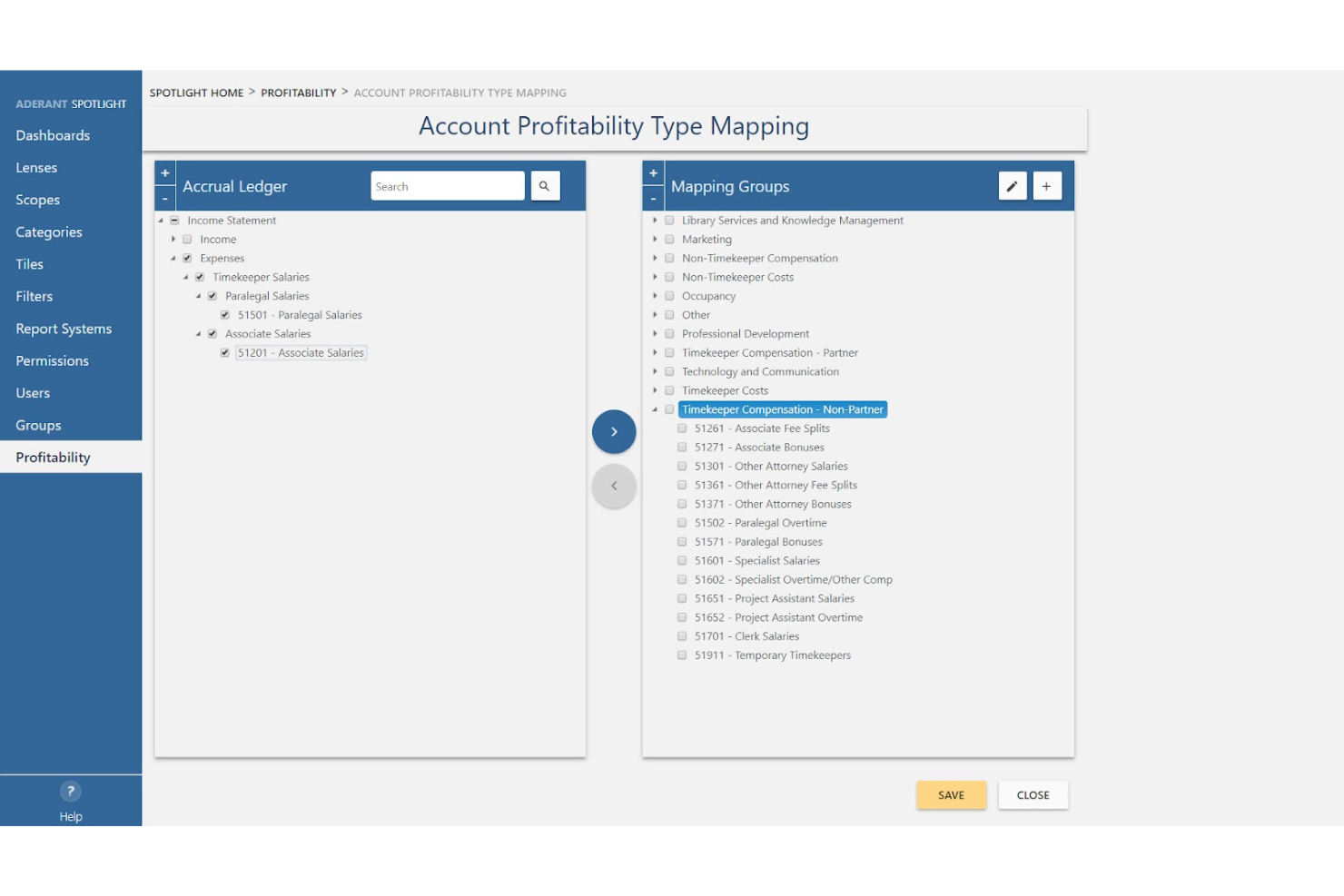

Aderant is legal management software aimed at large law firms. It focuses on practice management, billing, and business intelligence and offers solutions that help firms effectively manage their operations and financial performance.

Why I picked Aderant: Its capabilities cater specifically to the needs of large law firms, providing comprehensive practice management tools. The software includes advanced billing features, allowing your firm to handle complex billing scenarios easily. Business intelligence tools offer insights into your firm's performance, helping with strategic planning. Its scalability makes it suitable for large firms with diverse needs.

Standout features & integrations:

Features include advanced billing that supports complex fee arrangements and billing rules. Practice management tools help organize daily operations and tasks across the firm. Business intelligence tools provide analytics and reporting to support data-driven decision-making.

Integrations include Microsoft Office, iManage, DocuSign, Intapp, HighQ, NetDocuments, Salesforce, Elite, Chrome River, and Workday.

Pros and cons

Pros:

- Strong business analytics

- Scales with large firms

- Supports complex billing

Cons:

- High implementation time

- Steep learning curve

CaseFox is legal billing and case management software for solo practitioners and small law firms. It focuses on time tracking, billing, and case management and offers features that help attorneys manage their practice without breaking the bank.

Why I picked CaseFox: It provides a cost-effective solution for small firms looking to manage their billing and case details efficiently. With its straightforward time tracking, you and your team can easily record billable hours. The software's billing features allow for customizable invoices that suit your firm's needs. The case management capabilities help keep client information and case files organized, making it a practical choice for budget-conscious practices.

Standout features & integrations:

Features include time tracking that makes it easy to log billable hours. Billing features let you customize invoices to fit your needs. Case management keeps your client and case information organized and accessible.

Integrations include QuickBooks, Xero, Dropbox, Google Drive, Box, OneDrive, Clio, LawPay, Stripe, and PayPal.

Pros and cons

Pros:

- Efficient time tracking

- Customizable billing options

- Affordable for small firms

Cons:

- Basic reporting tools

- Limited advanced features

TimeSolv is time and billing software designed for law firms of various sizes. It focuses on time tracking, expense management, and invoicing and caters to firms that need efficient billing and financial management tools.

Why I picked TimeSolv: The tool offers offline access, enabling you to manage tasks without an internet connection. TimeSolv provides detailed time tracking, ensuring all billable hours are captured accurately. Expense management features make recording and tracking costs associated with your cases easy. The flexible invoicing system allows you to generate detailed and customized client invoices.

Standout features & integrations:

Features include time tracking that lets your team record billable hours even offline. Expense management helps track and categorize your costs efficiently. The invoicing system supports detailed and customized billing for your clients.

Integrations include QuickBooks, Dropbox, NetDocuments, Xero, LawPay, Microsoft Outlook, Google Calendar, Box, and TrustBooks.

Pros and cons

Pros:

- Flexible invoicing options

- Detailed expense management

- Offline time tracking

Cons:

- Occasional sync issues

- Limited customization

Bill4Time is legal billing and time management software designed for law firms. It focuses on time tracking, billing, and project management and serves firms that need precise tracking of billable hours and efficient billing processes.

Why I picked Bill4Time: It offers specialized time-tracking features that ensure every billable hour is accurately recorded. The software allows you to track time across different projects and clients effortlessly. Its billing system integrates with time tracking to generate detailed invoices automatically. The project management features help organize tasks and deadlines, aligning with its USP of being best for time tracking.

Standout features & integrations:

Features include comprehensive time tracking that allows you to record billable hours with precision. The billing system connects directly with time entries to create detailed invoices. Project management tools help you organize tasks and manage deadlines efficiently.

Integrations include QuickBooks, PayPal, LawPay, Box, Dropbox, Google Calendar, Microsoft Outlook, Stripe, Xero, and NetDocuments.

Pros and cons

Pros:

- Project management tools

- Integrated billing system

- Accurate time tracking

Cons:

- Setup takes time

- Limited reporting features

Legal Tracker is a legal management system designed for corporate legal departments, focusing on managing legal spend and matter management. It helps teams track expenses and streamline legal operations efficiently.

Why I picked Legal Tracker: It offers extensive tools for corporate legal teams to manage their legal spending and matters. The system provides detailed spend management features, allowing you to track and analyze costs effectively. Matter management is simplified with organized workflows and document management capabilities. The reporting and analytics tools help you gain insights into your legal operations, aligning with its USP of being best for corporate legal teams.

Standout features & integrations:

Features include detailed spend management, which helps you keep track of legal expenses. Matter management organizes cases and documents for efficient handling. Reporting and analytics provide insights into your team's legal activities, aiding decision-making.

Integrations include Microsoft Office, SAP, Oracle, NetDocuments, iManage, DocuSign, HighQ, SharePoint, TeamConnect, and Lawtrac.

Pros and cons

Pros:

- Strong reporting tools

- Effective matter management

- Detailed spend tracking

Cons:

- Complex initial setup

- Steep learning curve

Clio is practice management software for law firms of all sizes. It focuses on billing, client management, and payment processing and offers tools to help firms manage their operations and financial transactions efficiently.

Why I picked Clio: It provides integrated payment processing, allowing your firm to handle transactions directly within the platform. Clio's billing features enable you to create detailed invoices and track payments effortlessly. The client management system organizes all client information, enhancing your firm's service delivery. Its payment processing capabilities make it ideal for firms looking to centralize their financial management.

Standout features & integrations:

Features include integrated payment processing, which allows your firm to handle client payments directly through the platform. Billing features enable you to generate detailed invoices and track payment statuses. The client management system organizes client information and case details for easy access.

Integrations include QuickBooks Online, Xero, Dropbox, Google Drive, Outlook, LawPay, NetDocuments, Zapier, Microsoft 365, and Mailchimp.

Pros and cons

Pros:

- Strong client management

- Efficient billing tools

- Integrated payment system

Cons:

- Limited offline access

- Occasional syncing delays

Other Legal Invoicing Software

Here are some additional legal invoicing software options that didn’t make it onto my shortlist but are still worth checking out:

- mycase

For cloud-based access

- LeanLaw

For QuickBooks integration

- Smokeball

For automatic time tracking

- Rocket Matter

For cloud-based practice

- Harvest

For time tracking

- BigTime

For project budgeting

- Amberlo

For document management

- Bilr

For AI-driven billing

- LawPay

For payment processing

- Lawmatics

For client intake

- Brightflag

For e-billing compliance

- Centerbase

For customizable workflows

Other Legal Billing Solutions Reviewed

Here are some other tools you may need if you are looking for legal billing systems and tools.

Legal Invoicing Software Selection Criteria

When selecting the best legal invoicing software in this list, I considered common buyer needs and pain points like billing accuracy and compliance with industry regulations. I also used the following framework to keep my evaluation structured and fair:

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Billable time tracking

- Invoice generation

- Payment processing

- Expense management

- Client management

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Customizable templates

- Automated billing

- Multi-currency support

- Trust accounting

- Integration with practice management

- Online payments

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Intuitive interface

- Easy navigation

- Minimal learning curve

- User-friendly design

- Accessibility on mobile devices

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Interactive product tours

- Onboarding webinars

- Access to templates

- Chatbot assistance

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- Availability of live chat

- Responsive email support

- Access to phone support

- Comprehensive help center

- Availability of 24/7 support

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing

- Features offered vs. price

- Availability of free trial

- Flexible pricing plans

- Discounts for longer commitments

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Overall satisfaction rating

- Commonly reported issues

- Praise for key features

- Feedback on ease of use

- Comments on customer support

How to Choose Legal Invoicing Software

It’s easy to get bogged down in long feature lists and complex pricing structures. To help you stay focused as you work through your unique software selection process, here’s a checklist of factors to keep in mind:

| Factor | What to Consider |

| Scalability | Will the software grow with your firm’s needs? |

| Integrations | Does it integrate with tools your team already uses? |

| Customizability | Can you tailor the software to your specific workflows? |

| Ease of Use | Is the software intuitive for your team to use daily? |

| Budget | Does the software fit within your financial constraints? |

| Security Safeguards | Are there robust measures to protect your data? |

Trends In Legal Invoicing Software

In my research, I sourced countless product updates, press releases, and release logs from different legal invoicing software vendors. Here are some of the emerging trends I’m keeping an eye on:

- AI-driven analytics: AI is being used to offer deeper insights into billing patterns and financial metrics. This helps firms identify inefficiencies and optimize their billing processes. Vendors like Bilr are incorporating AI to enhance invoicing accuracy and decision-making.

- Blockchain for security: Some vendors explore blockchain technology software offers to secure transaction records and ensure data integrity. This is particularly relevant for firms handling sensitive financial data, providing an extra layer of trust.

- Client portals: More software solutions offer client portals that let clients view and pay invoices online, improving transparency and convenience. This feature enhances client satisfaction by providing easy access to billing information.

- Customizable dashboards: Having dashboards that users can tailor to their needs is gaining traction. This allows firms to focus on the most relevant metrics, improving efficiency and user experience, as well as profitability.

- Predictive billing: Predictive billing management solutions are emerging, helping firms anticipate future billing cycles based on historical data. This trend supports better financial planning and resource management for legal practices.

Features of Legal Invoicing Software

When selecting legal invoicing software, keep an eye out for the following key features:

- Time tracking: Records billable hours accurately to ensure precise invoicing and financial management.

- Automated billing: Generates invoices automatically based on logged hours and expenses, saving time and reducing errors and late payments.

- Client portals: Provides clients with access to view and pay invoices online, enhancing transparency and convenience.

- Customizable templates: Allows firms to personalize invoices and reports, maintaining a consistent brand image.

- Expense management: Tracks and categorizes costs associated with cases, helping firms manage their finances effectively.

- Integrated payment processing: Facilitates direct payment collection within the software, simplifying financial transactions.

- Compliance management: Ensures billing practices adhere to legal industry standards and regulations.

- Predictive billing: Anticipates future billing cycles using historical data, aiding financial planning.

- Customizable dashboards: Allows users to tailor dashboards to focus on the most relevant metrics for their firm.

- Reporting and analytics: Offers insights into billing patterns and financial metrics, supporting data-driven decisions.

Benefits of Legal Invoicing Software

Implementing legal invoicing software provides several benefits for your team and your business. Here are a few you can look forward to:

- Increased accuracy: Automated billing and time tracking reduce invoice errors, ensuring precise financial management.

- Improved client relationships: Client portals offer transparency and convenience, enhancing trust and client communication.

- Time savings: Automated processes like invoicing and payment collection allow your team to focus on more critical tasks.

- Financial insights: Reporting and analytics provide data-driven insights into your billing patterns and financial health.

- Enhanced compliance: Compliance management features help ensure your billing practices meet industry regulations.

- Flexibility and customization: Customizable templates and dashboards allow you to tailor the software to fit your firm's specific needs.

- Better financial planning: Predictive billing aids in anticipating future billing cycles, supporting effective financial planning.

Costs and Pricing of Legal Invoicing Software

Selecting legal invoicing software requires understanding the various pricing models and plans available. Costs vary based on features, team size, add-ons, and more. The table below summarizes common plans, their average prices, and typical features included in legal invoicing software solutions:

Plan Comparison Table for Legal Invoicing Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic time tracking, simple invoicing, and limited client management. |

| Personal Plan | $5-$25/user/month | Time tracking, invoicing, payment processing, and basic reporting. |

| Business Plan | $30-$75/user/month | Advanced billing features, client portals, expense management, and analytics. |

| Enterprise Plan | $80-$150/user/month | Customizable dashboards, compliance management, predictive billing, and integrations. |

Legal Invoicing Software FAQs

Here are some answers to common questions about legal invoicing software:

How does legal invoicing software improve billing efficiency?

Legal invoicing software automates many billing tasks, such as time tracking and invoice generation, reducing your time on manual processes. It ensures accuracy by linking billable hours directly to invoices. This reduces errors and helps your team get paid faster. Automation also means you can handle more clients without hiring additional staff.

You can also leverage legal invoice review solutions to have a second pair of eyes (human or digital) on your invoices to check for billing accuracy.

Can legal invoicing software integrate with other tools?

Yes, the best legal billing software can integrate with tools you already use, like accounting software and document management systems. Integrations help keep all your data in sync and reduce duplicate entries. Make sure to check the specific integrations offered by each software to ensure they meet your needs.

Is legal invoicing software suitable for small law firms?

Legal invoicing software is often scalable and can be tailored to suit firms of all sizes, including small practices. It helps you manage your billing efficiently, even as a solo practitioner. Look for solutions that offer flexible pricing plans that fit your firm’s budget and needs.

How secure is legal invoicing software?

Security is a top priority for legal invoicing software providers, as they handle sensitive client and financial data. Most solutions offer features like data encryption, user access controls, and regular security updates. Always verify the security features of the software you’re considering to ensure your data remains protected.

Can legal invoicing software help with compliance?

Yes, many legal invoicing solutions include features that help ensure compliance with industry regulations. These features include trust accounting and compliance tracking. By automating compliance-related tasks, the software helps reduce the risk of errors and ensures you meet legal standards.

How can legal invoicing be streamlined for small businesses using hourly rates?

Legal invoicing software with timers can track hourly rates efficiently, reducing the time spent on billing and improving accuracy. Many tools offer Android apps, making it easy for lawyers in various practice areas to log billable hours on the go.

What invoicing methods should be used for flat fees, retainers, and IOLTA accounts?

For flat fees and retainers, legal invoicing software can categorize payments and track funds in IOLTA accounts, ensuring compliance. Using LEDEs billing helps with detailed, standardized invoicing, reducing administrative time.

How can legal invoicing software help with contingency fees and credit card payments?

Legal invoicing platforms simplify contingency fee arrangements by automatically tracking settlements and client payments. Credit card integration allows clients to pay invoices faster, improving cash flow for small law firms.

What’s Next?

For more legal insights and resources, subscribe to our newsletter and join a community of innovative legal practitioners shaping the future of law.