Law firm accounting isn't just a tedious chore—it's a critical aspect of running a successful legal practice. When you moved from being an associate to leading your own firm, you expected legal challenges, not a financial labyrinth.

In this guide, I'll focus on the essential methods and tools needed for accuracy and compliance. I'll strip away the complexity so you can see law firm accounting as a manageable task that’s integral to your firm's success.

What Is Law Firm Accounting?

Law firm accounting is the process of handling all the financial activities within a law firm. It includes keeping track of money coming in from clients, paying the firm's bills, and managing payroll for staff. This system helps ensure that the firm’s finances are organized and accurate, making sure everything runs smoothly and complies with legal requirements.

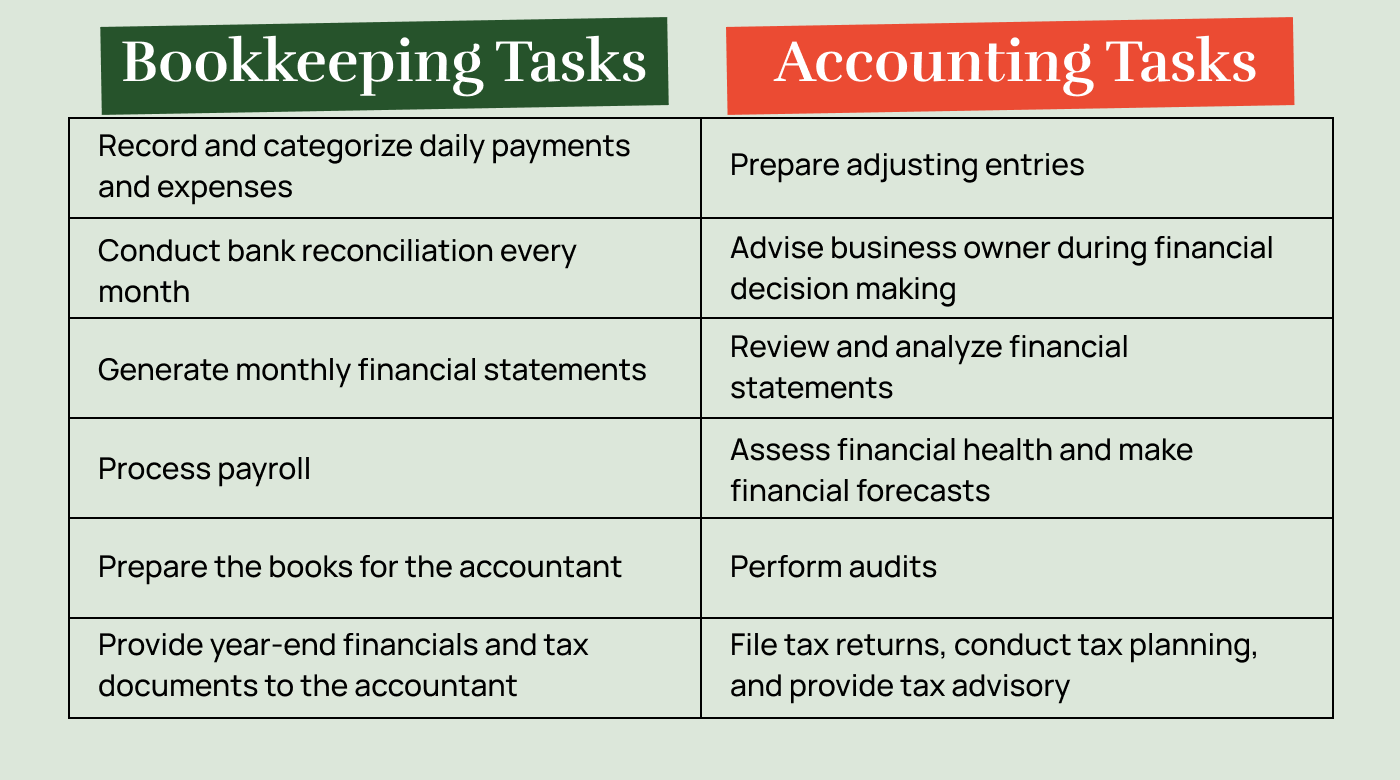

Bookkeeping vs Law Firm Accounting

What most people typically think of as accounting is traditional bookkeeping—balancing the books, debiting this account, and crediting that one. However, accounting is much more than that, as it focuses on interpreting, classifying, analyzing, and reporting a company’s financial transactions.

For law firms, accounting is made slightly more complex due to client trust accounts, and the dizzying array of regulations surrounding them. These regulations can make even the most experienced accountant’s head spin.

Law firm accounting also involves the ever-present specter of complex legal billing arrangements. Contingency fees, flat fees, hourly rates, blended rates—it’s a smorgasbord of potential revenue, each with its own accounting and reporting requirements. Add to that the need to track billable hours and expenses by legal billing codes, client number, or case number, and you’ve got yourself an accounting landscape as complex and fascinating as a top-tier legal case.

In small law firms, you’ll often find the accountant and the bookkeeper rolled into one. The same person dealing with the big-picture financial strategy is knee-deep in day-to-day transaction tracking.

So, understanding the intricacies of law firm accounting—including client funds, billing arrangements, and daily financial transactions—can seem challenging.

Fortunately, by the time you finish reading this, you’ll have the confidence to dive headfirst into the accounting world of your small firm.

Law Firm Accounting Responsibilities & Processes

Now that we’ve established what law firm accounting involves, let’s get into the nitty-gritty of how the typical elements of standard accounting work for specific law firm accounting needs.

1. Revenue Recognition

In accounting, recognizing revenue is all about timing and categorization. Knowing when to record income and distinguishing between earned and unearned fees is key to ensuring that financial statements reflect the firm’s health. Revenue recognition within law firm accounting is the same—a retainer might be recorded as unearned income until the service is delivered.

Standard accounting training and software that aligns with legal accounting standards can guide your firm through this maze, helping you hit all the right marks.

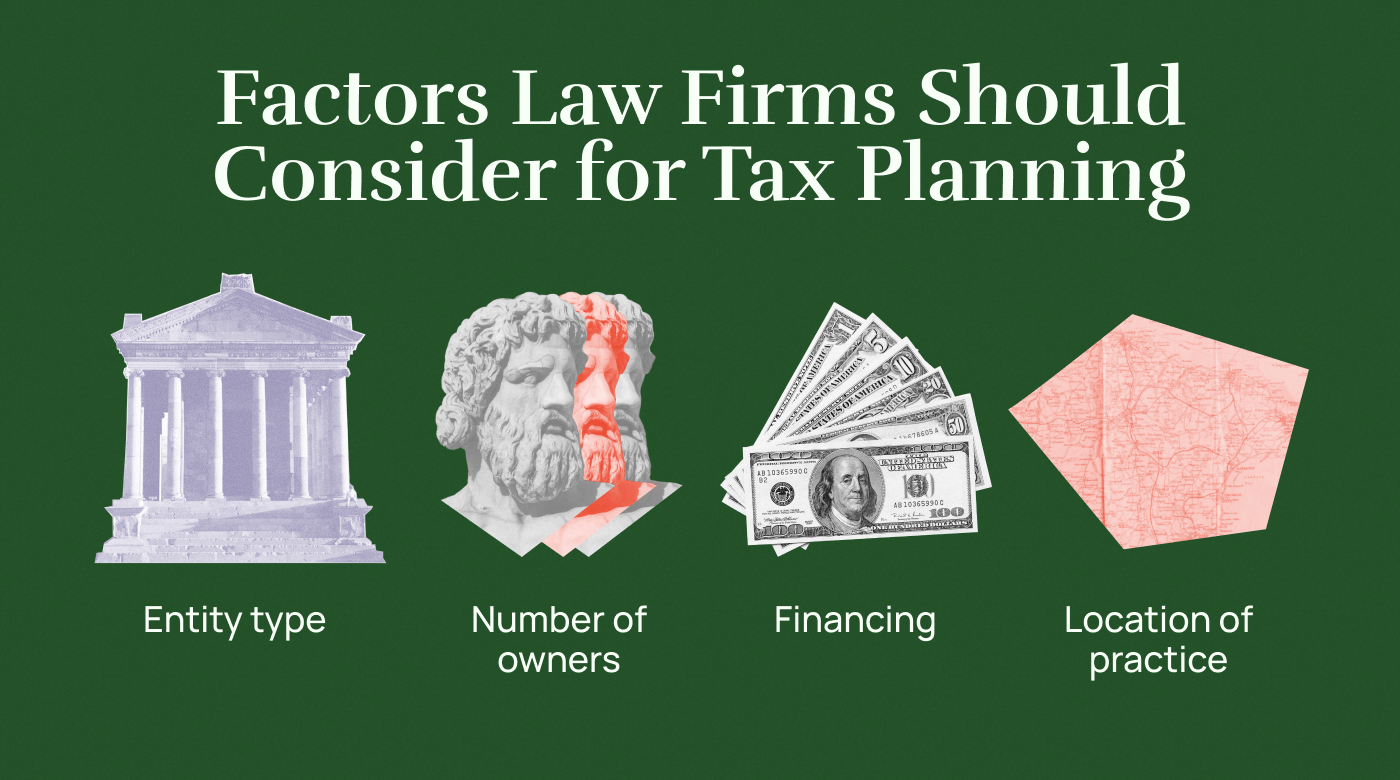

2. Tax Planning

Tax planning isn’t merely an accounting exercise. It’s a strategic blueprint that aims to minimize tax liabilities, all within legal bounds. For law firms, this might include using business expense deductions or employing a deferral strategy to delay tax payments. You’ll also want to consider your law firm’s entity type, the number of owners, financing, and the location of your practice. All of these will factor into how you plan for taxes.

3. Regulations & Compliance

As a lawyer, you’re no stranger to the idea of compliance. Every financial operation in your law firm must align perfectly with the regulatory requirements, from the loftiest budget decision to the smallest expense report. It’s all about creating an unshakeable framework that keeps the practice secure and thriving.

So, how do you ensure this level of meticulousness?

Investing in law firm accounting software can automatically flag any potential compliance issues. Another option is to hire specialized professional accountants with a solid understanding of law firm accounting who can closely monitor the firm’s financial health. Either of these will ensure you’re always on the right side of the law.

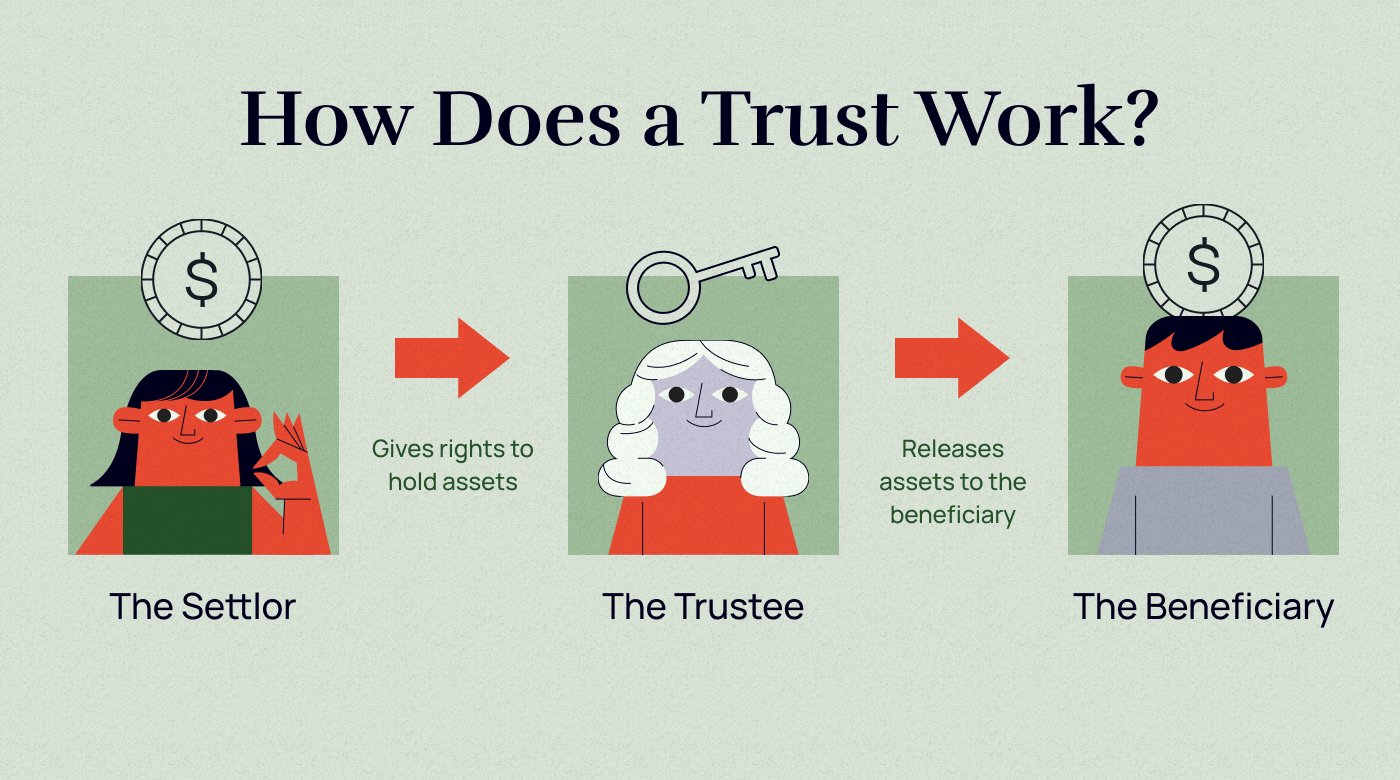

4. Client Trust Accounts

Client trust accounts (also known as Interest on Lawyer Trust Accounts, or IOLTAs) are a unique and delicate part of law firm accounting. They hold client funds separate from the firm’s finances, like retainers or settlement amounts. Accurately managing them is crucial, as even a minor error could escalate into an ethics violation.

Many dedicated trust accounting tools offer features such as automatic reconciliation and separate ledger management. These can safeguard against potential pitfalls and maintain the integrity of vital accounts.

5. Cost Recovery

Cost recovery, which is more intricate than it might seem, involves tracking client-related expenses and billing them appropriately. Everything from postage costs to witness interview fees needs to be considered.

A common pitfall in cost recovery is failing to document minor expenses, which can add up over time. Using expense tracking software designed for law practices can help make sure that everything that keeps your firm profitable is accounted for.

Law firm accounting is far from simple. Each element from tax planning to cost recovery adds a layer of intricacy. But don’t get discouraged. You can balance these tasks like an accounting pro with a few tips along the way.

Simplify your processes with reliable small law firm billing software.

Law Firm Accounting Software & Tools

Law firm accounting software is a tool used to manage a law firm’s financial tasks, like tracking payments, handling bills, and managing budgets. It helps make these processes easier and more accurate by automating many of the tasks involved.

Technology is transforming every aspect of our lives, including law firm accounting. Considering the intricacy of law firm accounting, you can happily be free of manual ledger entries and cumbersome spreadsheets.

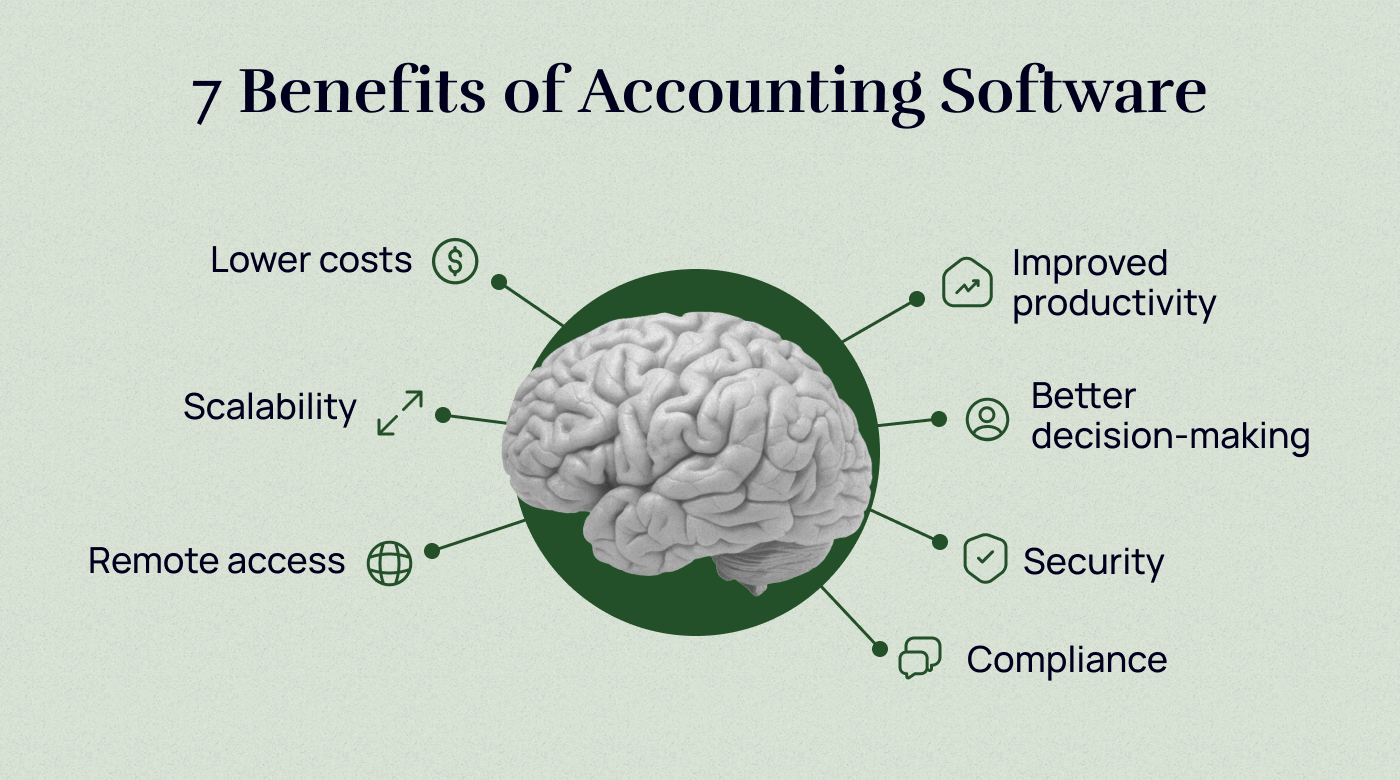

Law Firm Accounting Softwre: Benefits

Here’s what technology can bring to your small firm:

Efficient use of time: Imagine yourself drowning in a sea of paperwork, invoices, and financial statements. Billable hours slip away with each piece of paper. Now, imagine most of these tasks being automated, with only a few clicks needed on your part. You’ve freed up more time for client work, business development, or simply regaining a semblance of a work-life balance.

Reduce the chances of human error: Who hasn’t experienced that moment of panic when an invoice is missing, an expense is miscalculated, or a number in a financial report is transposed? Accounting software for law firms greatly minimizes such mistakes. Automated calculations, double-entry bookkeeping, and error alerts provide greater accuracy in your accounts. This gives you some peace of mind that you’re complying fully with regulatory bodies.

There are event specialized tools, like legal invoice review software, that are dedicated to catching common errors and maximizing your revenue by flagging billing issues before they bec ome a problem.

In-depth analysis and strategic insights: Accounting is no longer just about compliance and financial reporting. It’s a tool for strategic decision-making. Real-time financial data, easy-to-read dashboards, and in-depth reports offer insights into your firm’s performance, client profitability, and cash flow trends. This information can guide you in making decisions on everything from pricing strategies to resource allocation.

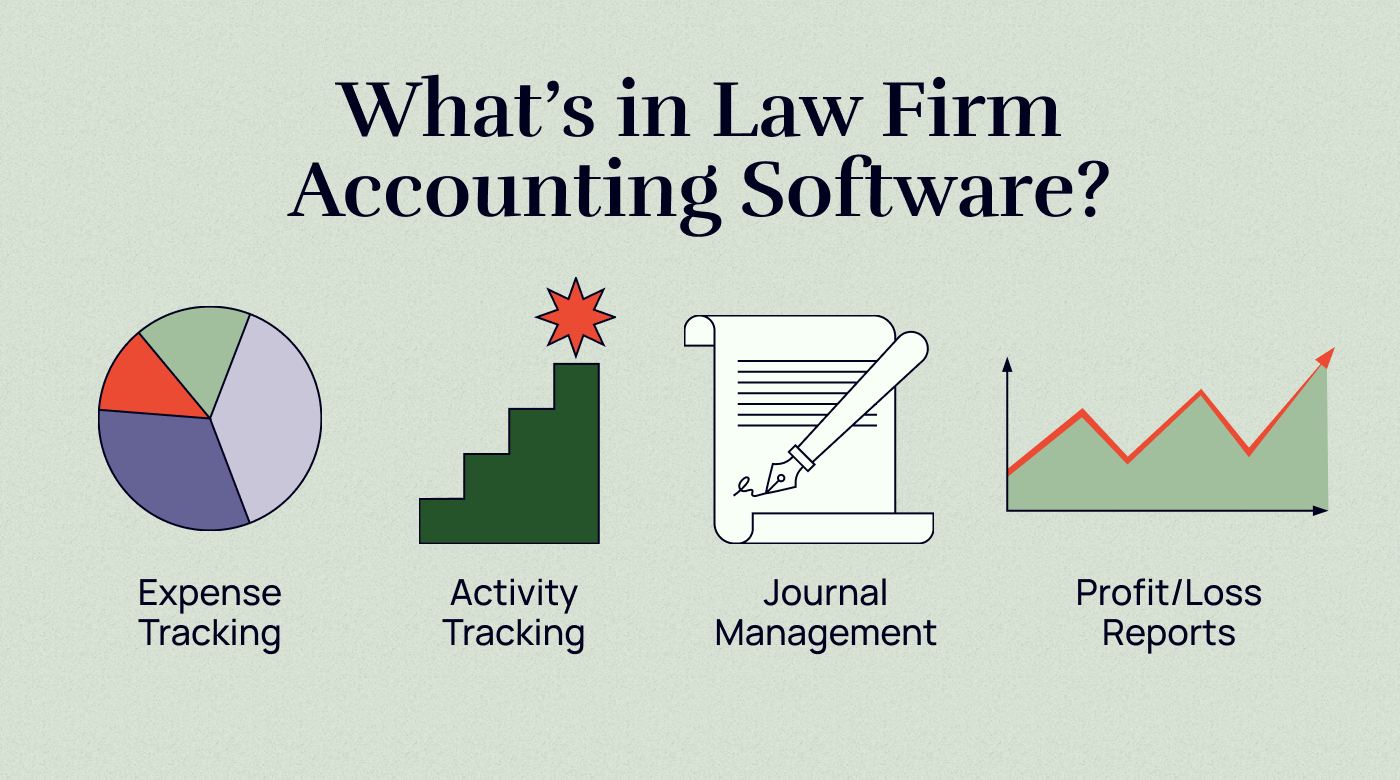

Here's a simple graphic that you can save and share with your nextwork:

Lawfirm Accounting Software: Key Features

As you integrate technology into your law firm’s accounting practices, picking the right law firm software is key.

Here are a few essential features to look for:

- Timekeeping: Look for a system that incorporates robust legal time tracking tools. This feature aims to keep track of billable hours and offer insights into how your team spends their time. It can inform decisions around workload distribution, efficiency improvements, and client communications.

- Trust accounting: The right software should make managing trust ledgers less of a minefield. It should automatically track each transaction and prevent overdrafts. Now, you have one location for maintaining in-depth records for audit purposes.

- Legal billing software: Automating invoicing can streamline the billing process, reduce the chances of errors occurring, and accelerate cash inflows. You want software that can generate professional, easy-to-understand invoices, manage recurring invoices, and give you real-time visibility into your firm’s receivables.

- Reporting: Access to clear, actionable financial reports is crucial. Choose software that can generate a variety of reports, such as income statements, balance sheets, and cash flow statements. This lets you track your firm’s financial health and make data-driven decisions.

- Expense tracking: A tool that can efficiently track and categorize expenses will save you many headaches. It should be able to handle everything from general office expenses to client-related costs.

- Legal spend management system: A tool to gain better visibility into their financial activities, track expenses more accurately, and ensure compliance with client billing guidelines.

- Integrations: Being able to connect seamlessly with your legal practice management software, CRM solution, time tracking tools, and other day-to-day workflow systems is critical.

Other Types of Law Firm Software

I’ve compiled reviews of what I believe to be the best software picks for your legal practice:

- Best Free Legal Billing Software

- Best Accounting Software for Small Law Firms

- Best Estate Planning Software

- Best Legal Hold Software

- Best Legal Drafting Software

- Best Legal Research Tools

Embracing technology in law firm accounting isn’t merely a modern convenience—it’s a strategic move that can power your practice’s growth and efficiency. And the right accounting software can transform legal accounting into a straightforward, manageable process.

Popular Misconceptions About Law Firm Accounting

Jumping into a new area can be scary, but it doesn’t have to be. Here are some misconceptions that need debunking:

Misconception 1: Bookkeeping Is Enough for Small Firms

Believing that bookkeeping alone is enough for your small law firm is like believing that knowing the law is enough to win a case. Bookkeeping is the foundation—the facts of the case, if you will. But accounting is the strategy—the case’s narrative.

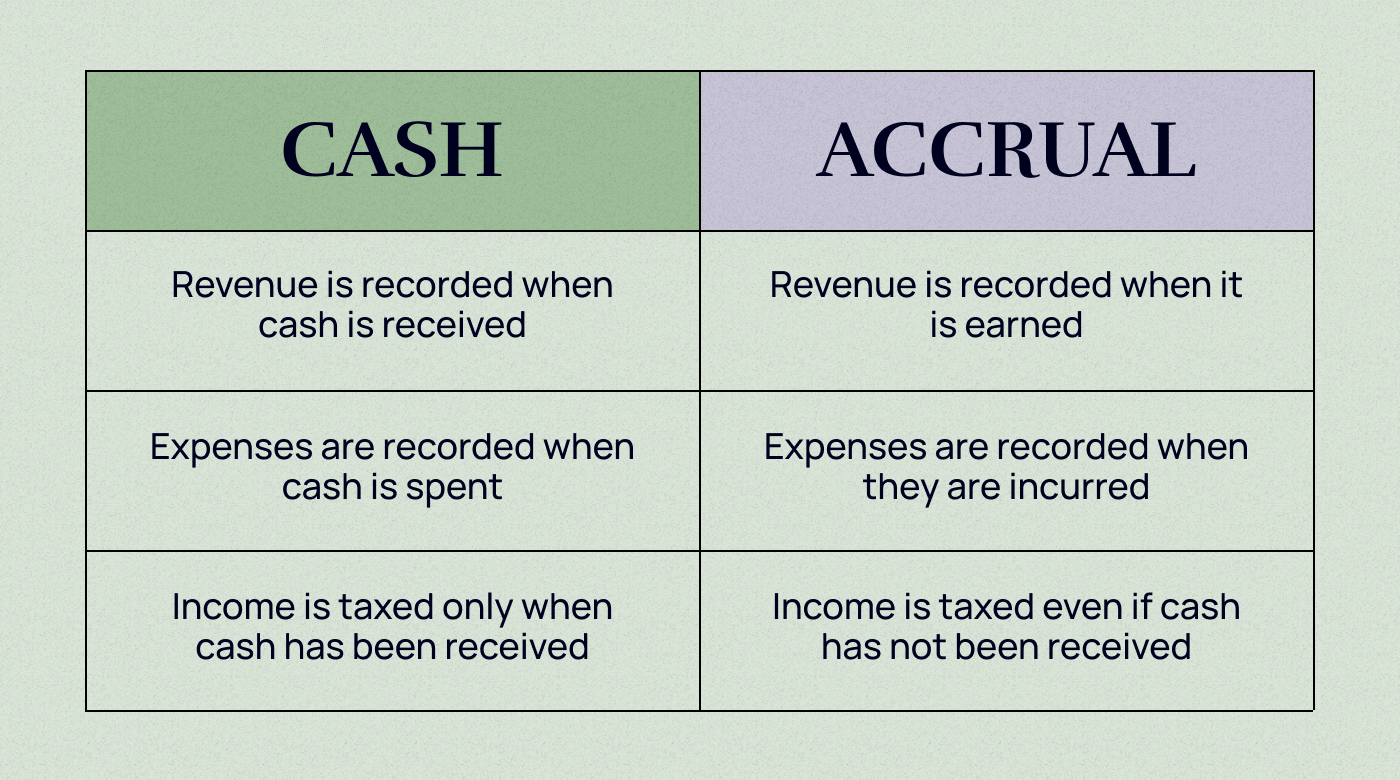

It starts with choosing a method of accounting, whether it be the accrual method or the cash method. By choosing cash basis accounting, you record income and expenses as the money arrives and leaves your firm’s operating account.

With accrual-based accounting, recording happens as soon as the client is invoiced—but before the money has hit your account. Each system can have pros and cons depending on the firm’s situation.

From there, your accounting practices can steer your firm toward more profitability. Remember, your accounting strategy allows you to analyze your firm's efficiency beyond basic bookkeeping. It’s your tool for growth and success.

Misconception 2: Only Large Law Firms Need Specialized Accounting

Think your small law firm doesn’t need specialized accounting practices? Think again.

Regardless of the size of your firm, sound accounting practices are critical. Smaller firms can benefit enormously from specialized accounting software, primarily because this software optimizes their limited resources.

And there are even more benefits for your small law firm than just the general role technology plays. For a small firm, specialized accounting technology can:

- Cut costs: Automated accounting systems remove the need for manual entry and reduce the risk of human error. Saving time on administrative tasks helps your team focus on delivering top-notch legal services—ultimately improving your firm’s bottom line.

- Support scalability: As your practice grows, so does your accounting workload. Law-specific accounting software is designed to scale with you. It effortlessly accommodates additional clients, cases, and the resulting financial complexities.

- Offer remote access and visibility: With cloud-based accounting software, your financial data can be accessed anytime, anywhere. You can track your firm’s financial health whether you’re in court, at home, or on the move. What’s even better is that you can remotely track billable hours and generate invoices with automated legal invoicing tools.

- Improve productivity: Automating repetitive tasks, such as data entry, timekeeping, and invoicing, means your team can spend their time on more valuable tasks. A streamlined workflow means more time spent serving clients and growing your firm.

- Allow for better decision-making: In-depth, real-time reporting provides insights through which to improve your decision-making. By understanding your firm’s financial health and identifying trends, you can make strategic decisions to optimize your operations and improve your profitability.

Misconception 3: All Accounting Software Is Created Equal

It’s a common assumption that all accounting software works in the same way, but that’s not the case. This software varies greatly depending on the specific needs of the law firm.

From tracking billable hours and managing trust accounts to producing in-depth financial reports, certain software shines in areas where others fall short. It’s important to pick a system that fits with your firm’s operations and budget.

With these misconceptions debunked, you’re one step closer to becoming more efficient and productive.

The Challenges Of Law Firm Accounting

Navigating the financial maze of law firm accounting doesn’t have to be difficult. With the right approach and understanding, you can transform challenges into victories, guiding your firm to success.

Let’s dive into some of the most common hurdles and how to overcome them with confidence.

Balancing Financial Compliance With Profitability

Financial compliance is the complex dance of keeping your financial practices in line with regulatory requirements. Profitability, on the other hand, is your firm’s ability to generate profit over costs.

The challenge with this balancing act is that if you miss a step in compliance, you’re staring at legal trouble. Ignore profitability, and your firm might get run into the ground financially.

So, how do you juggle both compliance and profit? Here are some tips:

- Maintain accurate records: A simple ledger error can snowball into a compliance nightmare. Using law-specific accounting software can help maintain accuracy. For example, software with real-time data synchronization and automatic error detection guarantees you are always on top of compliance without sacrificing efficiency.

- Bill and collect efficiently: Implement practices to minimize billing errors and speed up collections. Law-specific accounting software often includes features that help streamline the legal billing process, like customizable invoicing templates and automated follow-ups.

- Reduce expenses: Regularly review and adjust your expenses to align with your firm’s profitability goals without compromising compliance.

Creating a balance between financial compliance and profitability isn’t just a nice-to-have—it’s a must-have. With the right strategies, tools, and a keen eye on the legal requirements specific to your practice, you can follow the law and make a profit.

Understanding Client Trust Accounting and Its Implications

Client trust accounting refers to managing funds that your clients entrust to you for specific purposes.

Even the most experienced legal professionals can make trust accounting mistakes. The consequences of trust accounting errors and the mishandling of client trust funds can be severe. But the damage to your firm’s reputation might be irreparable. Facing a disgruntled client who finds that their funds were misused can become a nightmare.

Here’s how to navigate this delicate area:

- Streamlining trust accounting: Look for dedicated trust accounting tools that include features like automatic three-way trust reconciliation and individual client ledgers. These tools are designed to meet the unique requirements of trust accounting, ensuring that you stay compliant.

- Avoid commingling funds: Keep your client funds separate from your operating account. A specialized trust account guarantees that client funds are isolated and any mixing can be avoided, saving you from potential legal headaches.

The right strategies and tools can turn maintaining client trust accounts from a challenging task into a seamless process. Your firm’s reputation will stay intact as a result, and you’ll avoid potential pitfalls. In the fast-paced world of law, where trust is paramount, these practices are a necessity.

Early Tax Preparation

Early tax preparation is all about organizing, strategizing, and aligning your financial documents to avoid last-minute rushes. The challenge of it is simply doing it! Procrastination in tax preparation can lead to overlooked deductions, errors, and costly late filing penalties.

Overcoming this challenge might seem easy. But being a pro during tax time involves specific tactics that every law firm should know. These include the following:

- Understand relevant tax codes: Tax laws are filled with potential deductions and credits specific to law firms. Understanding how to deduct legal research costs or client entertainment can save you money.

- Maintain proper documentation: Keep all tax-related documents organized throughout the year. Consider using a dedicated accounting software designed for law firms that can easily track expenses, payments, and deductions.

- Focus on applicable tax laws: Collaborate with a tax professional who understands the legal industry. This collaboration will make sure that you’re complying with all relevant laws, like understanding how to properly handle client retainers and trust accounts in your tax filings.

- Utilize technology: There’s tax preparation software that caters specifically to law firms. Implementing this tech will guide you in capitalizing on legal-specific deductions and maintaining accuracy.

Just as you wouldn’t approach a case without thorough preparation, don’t approach tax time unprepared. Embracing early tax preparation isn’t just about being compliant. It’s a strategic move that optimizes your firm’s financial health.

Overcoming challenges in law firm accounting requires preparation, understanding, and a willingness to adapt and implement best practices. While the path might seem filled with obstacles, remember that every successful hurdle makes you stronger and guides your firm closer to the finish line.

Conclusion

Accounting in your small law firm might seem exhausting, especially when your passion lies in practicing law. But effective law firm accounting isn’t just necessary—it’s a strategic advantage.

With the right tools, technology, and insights, your legal practice can meet compliance requirements and provide clients with top-tier service, all while turning a profit.

Whether you’re a legal industry veteran or just starting your own practice, subscribe to our newsletter for the latest industry news, legal tech guides, and more original, actionable insights.